There’s an interesting dichotomy at play in the Australian housing sector. As the responsibility to provide rental accomodation continues to fall increasingly on private citizens (with a marked decline in public housing supply), more and more people are being funnelled into a life of long term tenancy.

At a time when governments are stepping away from affordable housing provision, with state authority homes accounting for just 3.5 per cent of rental stock by 2015-16 (from its peak of 6.0% in 1995-96), housing affordability has hit an all time low and not surprisingly, home ownership is on the decline.

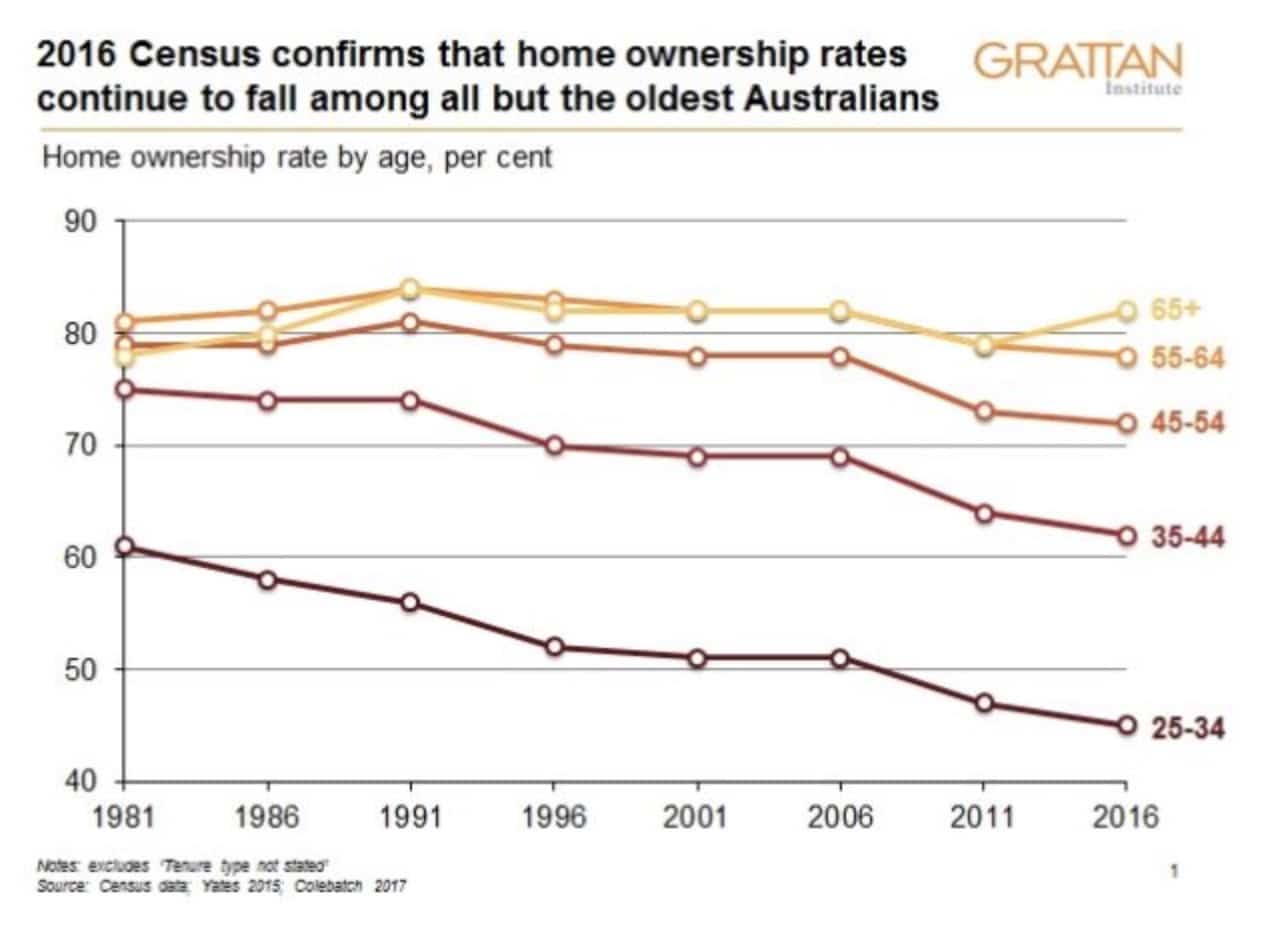

More tenants are flooding the market now, seeking affordable, long term rental opportunities. After peaking at around 71% and traditionally hovering at 70% since the 1960’s, the percentage of home owners in this country decreased significantly to 67% in 2011, the lowest level in over 50 years.

Get used to it

Many industry analysts are suggesting this trend could continue indefinitely, warning a large portion of young Aussies may have little choice but to become “permanent renters”.

In 1986, 58 per cent of 25 to 34 year olds owned their home. By 2017 that number was down to 45 per cent, with the most notable decline occurring in the last decade.

What does it mean for investors?

Property investors would do well to acknowledge this growing cohort of longer term tenants now. These more savvy, selective and cashed up prospects for your rental property mean the potential to secure reliable occupants for your asset, who will treat it as they would their own home.

For many, it could well be that your investment turns into their family home for years to come. Particularly if you are targeting the family tenant market.

Imagine not having to concern yourself with constant tenant changeovers and agency reletting fees, because you’ve secured a “permanent renter” who’ll reliably pay their rent on time and take care of your property! It’s every landlord’s dream!

For that to happen however, landlords need to be mindful of how they’re property is managed and what they’re offering to prospective tenants.

How to find a “permanent renter”

Longer term tenants are going to be more discerning than someone looking for a place to crash while they go to Uni. You need to cater to their specific requirements and understand that this isn’t just a “rental” for them. It’s the place they’ll make memories with friends and family. It’s a place they’ll be emotionally invested in, perhaps for many years to come.

Start by stepping into their shoes and considering what you would want from longer term rental accommodation.

One of the ongoing bones of contention between landlords and tenants, and a clear way in which property investors may be missing the big picture, “permanent renter” potential, is around pet ownership.

Many investors are loathe to approve pets living alongside their owners in rental properties. In fact this has become one of the sticking points for Victoria’s Parliament, where proposed legislative reform that would prevent landlords from stopping a tenant having pets continues to be hotly debated.

Peak industry bodies and some members of the state government have argued that giving tenants more rights could cause investors to leave the property markets in droves.

This backward and forward over Victoria’s proposed regulatory amendments has simply highlighted the growing divide between private landlords and their tenant market, where it seems increasingly a case of “us versus them”. When ironically, it should in fact be two parties working on the same team to maintain their home (the tenants) and their asset (the landlords).

If the emotion was removed from the debate on both sides, logic would highlight that tenants and investors have very common interests when all is said and done. Or at least, that’s how it should be!

3 ways to hook a “permanent renter”

It’s not rocket science, and it really doesn’t take a whole lot of challenging or costly research to understand your tenant market. Think about what you appreciate in your own home…

- The opportunity to have a furry friend or two

Denying tenants the right to have a pet reside with them means alienating a large proportion of your potential rental market. Particularly the long term tenant type.

When you consider that 62 per cent of all Australian households own a pet of some kind, it’s obvious you’ll be missing out on a lot of opportunities by inserting a “no pet clause” in your tenancy contract. And if you’ve had pets and children, you’ll know which one can be more destructive!

2. Things working properly!

If your property manager calls with a maintenance item that seems relatively benign to you – perhaps it’s a constantly leaking bathroom tap – don’t be tempted to simply dismiss it as ‘not my problem’.

Going the extra mile to promptly and effectively address maintenance issues, be they big or small, tells your tenants you care about their wellbeing and comfort. And that will definitely work in your favour.

Not only that, you want a tenant who’s happy to communicate any potential maintenance issues with our investment. Because you want your investment to stay in tip top condition, right?

3. Basic privacy

I often wonder how many landlords read their lease from start to finish. Some seem entirely dismissive of the standard clause in most residential tenancy agreements that states, ‘The landlord must take all reasonable steps to ensure that the tenant has quiet enjoyment of the premises.’

Lack of respect for their privacy is one of the biggest beefs tenants have when it comes to renting. Maintain a courteous and professional relationship with your tenants. Preferably, when paying a property manager to be your go-between, try not to be a part of their lives at all. Unless they really want you there of course!