The dream of owning a home is becoming a reality for more first-home buyers in NSW and ACT, thanks to recent changes in stamp duty thresholds and support programs.

These changes, reflecting a shift towards greater support for first-home buyers, will help more people realise more wealth through property.

Let’s take a look at these changes, and what they mean for first-home buyers.

NSW’s First Home Buyer Assistance Scheme (FHBAS) has been expanded

The NSW Government has taken significant steps to enhance the prospects of aspiring homeowners through the expansion of the First Home Buyer Assistance Scheme (FHBAS).

Effective from July 1, 2023, eligible first-home buyers in NSW will experience expanded benefits under the FHBAS.

One of the key changes is the increase in the transfer duty exemption threshold. Previously set at $650,000, the threshold has now risen to $800,000 for both new and existing home purchases. This means that first-home buyers acquiring properties below this threshold will be exempt from paying transfer duty, significantly reducing the upfront costs associated with buying a home.

Moreover, the concessional rate threshold is also receiving a substantial boost. Previously capped at $800,000, it will now extend up to $1 million. Under the concessional rate, eligible first-home buyers will pay reduced transfer duty for properties falling within this price range, providing additional savings during the home-buying process.

The NSW government has also made changes to various housing schemes, grants, and exemptions

In addition to the changes in the First Home Buyer Assistance Scheme (FHBAS), the NSW Government has implemented modifications to the residence requirement for various housing schemes, grants, and exemptions. These changes aim to ensure that first-home buyers benefit from the support programs while also fulfilling certain residency criteria.

Effective for contracts entered into on or after July 1, 2023, first-home buyers under the schemes mentioned below must adhere to the new residence requirement:

- First Home Buyers Assistance Scheme: Under this scheme, eligible first home buyers may be entitled to benefits such as exemptions and discounts on transfer duty for properties meeting specific criteria. To avail of these benefits, purchasers must move into their homes within 12 months of settlement and reside in the property continuously for a 12-month period.

- First Home Owner Grant: The First Home Owner Grant provides financial assistance to first-home buyers purchasing or building a new home. To qualify for this grant, buyers must also comply with the new residence requirement, residing in the property for a continuous 12-month period following settlement.

- Deferral of Transfer Duty Payment for Off-the-Plan Transactions: The deferral of transfer duty payment for off-the-plan transactions offers relief for buyers purchasing properties before completion. Under the revised requirements, purchasers must meet the same residence criteria as mentioned above.

NSW’s First Home Buyer Choice (FHBC) program has closed

Until June 30, 2023, purchasers had the option to opt-in to First Home Buyer Choice (FHBC) program, allowing them to choose between property tax and transfer duty on new purchases. But from July 1, 2023, this option is no longer available.

First-home buyers are required to pay transfer duty on their property purchases, which makes it all the more crucial to take advantage of the higher exemption and concessional rate thresholds provided under the FHBAS.

First Home Guarantee Scheme (HGS)

While the changes to stamp duty thresholds in the NSW First Home Buyer Assistance Scheme are aimed at easing the path to homeownership, aspiring buyers should also consider other attractive options available across Australia.

The First Home Guarantee Scheme (HGS) offers one such opportunity—whereby homebuyers can access government assistance when purchasing properties with higher purchase prices.

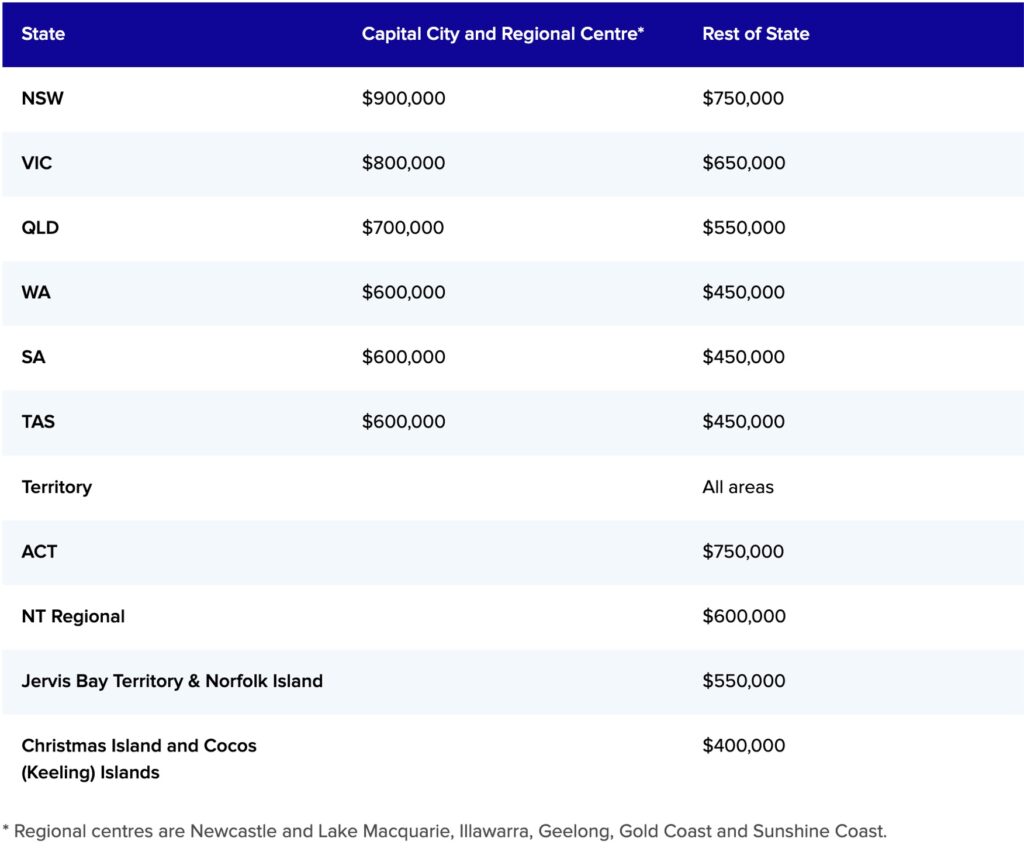

These exciting price caps enable them to explore a broader range of properties within a more generous budget:

Source: https://www.nhfic.gov.au/support-buy-home/property-price-caps

Navigating the Homebuying Process with Expert Guidance

For first-home buyers, the recent changes to stamp duty thresholds and the attractive First Home Guarantee Scheme (HGS) present exciting opportunities.

However, navigating the complex process of buying a first home can be overwhelming, especially with the new eligibility criteria and requirements.

To make the most of the available benefits and secure their dream home, aspiring homeowners can greatly benefit from seeking expert guidance from experienced mortgage brokers like Trilogy Funding.

Here are some ways in which we can assist first-home buyers:

- Understanding Eligibility: We’ll help you understand the eligibility criteria for the First Home Buyer Assistance Scheme (FHBAS) and the First Home Guarantee Scheme (HGS).

- Exploring Loan Options: We have access to a wide range of loan products from various lenders. We’ll help you explore loan options that suit your financial capacity and preferences, making it easier to choose the right mortgage for your circumstances.

- Budgeting and Affordability: With an in-depth understanding of property prices and the changes in stamp duty thresholds, we can assist you in determining a realistic budget for your home purchase.

- Securing Pre-Approval: We can facilitate the pre-approval process, helping you obtain a pre-approved loan before you start house hunting. Pre-approval provides you with the confidence to make offers on properties, knowing you have the financial backing to proceed.

Getting started

If you’re looking for an expert team to help with the finance for your first home (and a foundation that will help you grow wealth through property), request a 30-Minute Finance Strategy Session during which you will…

- Understand how much of a deposit you will need, and other things you will need to demonstrate to satisfy lending criteria

- Get a better understanding of the lending options available to you, so you can buy your first home with confidence

- Discover no-cost ways to save money on interest, fees, and charges

- Get an up-to-date picture of the lending landscape including rates, conditions, and how to structure loans

- Learn about our process to find you a competitive loan that could save you thousands in the long term

This no-obligation session will be held with one of our experienced mortgage brokers.

Please be assured this will not be a thinly disguised sales presentation. On the contrary, you’ll receive our best strategic advice, specific to your situation, so you too can get started on your home ownership journey, accumulate multiple properties without sacrificing your current lifestyle, and accelerate your progress towards wealth.

Schedule Your FREE 30-Minute Finance Strategy Session Today

Please note, the numbers and assumptions listed in this article are for educational purposes only. Individuals should seek specific advice pertaining to their unique situation and the real estate market before making any decisions.

Trilogy Funding Two is a corporate credit representative (Representative Number 506131) of BLSSA Pty Ltd, ACN 117 651 760 (Australian Credit Licence 391237)

References:

https://www.revenue.nsw.gov.au/news-media-releases/support-for-first-home-buyers-is-changing

https://www.nhfic.gov.au/support-buy-home/property-price-caps