The International Monetary Fund (IMF) has called on regulators to rein in booming Sydney and Melbourne house prices, warning that the nation’s economic growth could be threatened by an overvalued property market. The IMF said that there was a risk of “over-exuberance” setting in as housing markets continued to strengthen. It cited predictions of annual price rises of up to 20 percent in Sydney and Melbourne this year, amid strong investor demand.

At the top of the year, more than half of Australians who were surveyed agreed that now is a good time to buy property because prices will continue rising – but the IMF insisted that the government should act before it becomes too late. The Reserve Bank warned last week about the risks posed by high household debt levels, which are among the highest in the world.

Treasurer Josh Frydenberg has given his support to Australian regulators to curtail high-debt home loans in order to reduce the risk of a subprime crisis from record-low interest rates and booming property prices.

High debt ratios among new borrowers have been exacerbated with ultra-low mortgage rates, allowing people who would otherwise be unable to afford it to borrow even more than before; this is despite some warnings that such practices may not prove sustainable over time.

Mr Frydenberg was initially supportive of the boom that saw more first home buyers and owner-occupiers entering the market.

“A positive feature of this housing cycle compared to that of the last is a higher proportion of first home buyers and owner-occupiers entering the market … with Australia’s economy well positioned to strongly recover as restrictions ease, it is important to continually assess the appropriateness of our macroprudential settings.”

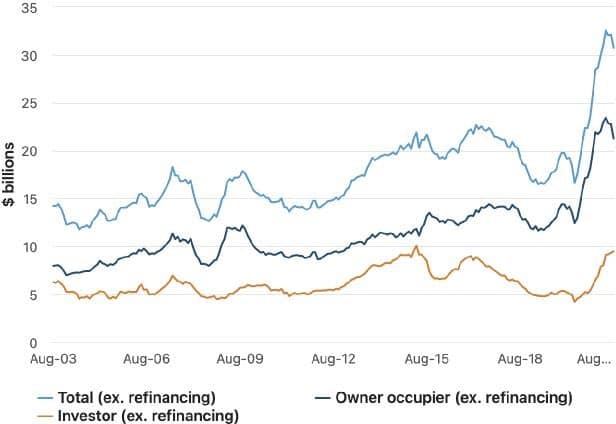

The recent changes in property buying habits seem to be leading policymakers towards regulatory action. While owner-occupiers were originally the driving force behind new borrowing, it is now investors that are doing most of the heavy lifting–and they are not slowing down anytime soon. The July figures showed landlord loans had grown 1.8% during that month alone (versus a decrease among those who own homes) and nearly doubled from twelve months ago at just over $6 billion dollars worth of lending by landlords compared with less than half ($3).

The recent Australian Bureau of Statistics August lending indicators reported that new investor housing loans rose by 1.5%, compared to a 6.6% fall in owner-occupied housing.

The IMF identified increased investor demand along with owner-occupiers and stimulus programs as the driving force behind surging property prices. In their most recent country report, the IMF suggested that 3 key options may prevent the situation from getting further out of hand: monitoring lending standards… “increasing interest serviceability buffers and instituting portfolio restrictions on debt-to-income and loan-to-value ratios”.

In a reply to the House of Representatives Standing Committee – publicised in August 2021 – the Reserve Bank (RBA) Governor expressed the opinion that most lenders practised responsible lending and, that the Australian Prudential Regulation Authority (APRA), would support the RBA to curb any irresponsible lending practices.

“We’re not in a situation where we were last decade where almost half the loans in the country were being made without one dollar of principal having to be repaid on a regular basis. These were interest-only loans. And you’ll recall last decade there’d been a very dramatic listing in lending standards for investors. So we’re not seeing that and we’re not seeing the interest-only loans and we’re not seeing underwriting standards weaken, which is all positive. If we were to see those things, you could expect APRA would support the Reserve Bank to take some action, but, at the moment, that’s not happening”, Mr Lowe said.

Seasoned analysts project that APRA will curtail debt-to-income ratios by thwarting how much an applicant can borrow in relation to their household income. It is likely that they will restrict the proportion of loans given out to six times that of the household income.

The home loan lending restrictions appear to be imminent. In the Quarterly Statement by the Council of Financial Regulators – released on 29 September 2021 – the Council discussed the risks associated with the current Australian lending conditions. They noted that the ongoing lockdowns led to a combined drop in the number of listings and sales, but house prices continue to rise. The council also confirmed that it had been in discussions with APRA to trigger macroprudential policies to address this.

Contact Trilogy today for a free 30-minute finance strategy session to find out how you can continue to grow your property portfolio before the current favourable lending conditions are quickly phased out.