Very few property investors have more than one investment property in their property portfolio. The idea of the island hopping landlord is merely a caricature that is simply not supported by the data. When you look at how much they earn from their day jobs and their properties combined, most property investors are ordinary people who happen to supply much-needed housing stock to a fiercely competitive rental market.

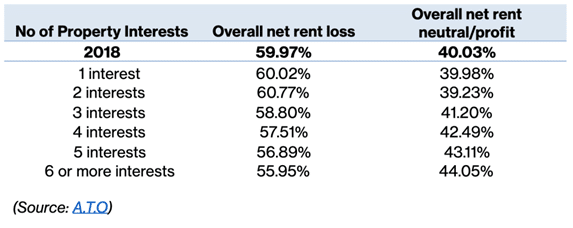

According to the ATO, only 10% of investors hold more than two investment properties. Meaning that 90% of investors have less than two properties. Also, a vast majority of these properties are negatively geared or are not generating an income for the owners, making it harder for these investors to purchase more properties.

The benefit of owning more than one investment property is the potential for more capital gains and to grow passive income from profitable properties. These benefits are quite persuasive for the investor who is looking to retire sooner or in a more comfortable position.

6 Tips that May Help you Buy More Investment Properties

1.Get a Property Investment Team

To grow a property portfolio takes time and know-how, for this reason, it is considered prudent to pick your winning property investment team from the jump.

The essential members you will need for your team include a mortgage broker, accountant, conveyancer or property lawyer, buyers agent, real estate agent, financial planner and property manager. You may find that you can leverage the expertise of even more professionals as your portfolio grows, but these team members are a good place to start.

2. Draw up a Property Investment Strategy

Tap into the amazing knowledge base and experience of your dream team to draw up a property investment strategy. The more detail you can put into it the better. Clearly identify what your long-term goals are and the types of properties that can help you achieve this sooner rather than later. This is a key step to help you save time in your property hunt and ideally avoid any losses through careful planning.

3. Consider Positive Gearing

Cashflow positive properties make you money and may help you with repayments on your property loans if there are enough of these type of properties in your portfolio. They are notoriously difficult to find and the competition for them is fierce. But here is the main reason why you want to hunt for these type of properties: serviceability. They can help you to afford to purchase more investment properties – compared to having lots of negatively geared properties in your portfolio – as they are more well regarded by lenders.

4. Leverage your Equity

If you are among the lucky few who already own more than one property – and your investment strategy supports this – consider leveraging the equity in these properties to fast track the purchase of your next investment. You can usually borrow up to 80% of the value of the equity in your property thereby bypassing the slow process of stacking up the necessary deposit. There are lots of pros and cons to this strategy and it is always best to discuss these with a lending professional who can help you to better understand and even calculate your equity.

5. But avoid Cross Collateralise

An automatic cross securitisation or crossing is a common policy among many Australian lenders. In a worst-case scenario, it may mean that an investor would be forced to sell one of their properties to pay for the other property, even if they have two different mortgages but with the same bank.

The best option is to always structure the new loans on your property in a way that avoids the risks associated with crossing. Use different lenders or an uncrossed structure.

6. Take on a Renovation

Renovations can be a smart way to increase the rental yields and capital gains of an investment property. Minor renovations like painting, cosmetic upgrades and some curb-appeal TLC can increase both the rents you can charge on your property and its appraised value.

The uptick in the appraisal price of your recently renovated property can be used to purchase more investments – through equity and serviceability – when combined with a holistic investment strategy and by working with experienced industry experts.

These are just some of the ideas that may work to help you grow your property portfolio and to join the exclusive club of Australians who actually own more than one investment property.

There are lots more tips that may work just as well if not better for you, depending on your individual financial circumstances. The main takeaway, however, is that planning and having the right team of property professionals on your side is the key. Start with a mortgage broker who has won the top 25 brokerages award two years running. The Trilogy team start with a free strategy session to help you make your property goals a reality.