People who own or invest in a house in Canberra can now be sure that it was a smart property investment. These good folks are officially members of the million-dollar club. The median house price in Canberra has soared past the $1 million price tag, spurred on by a feverish growth in buyer demand, creating a windfall of equity for those who are lucky enough to own a house there.

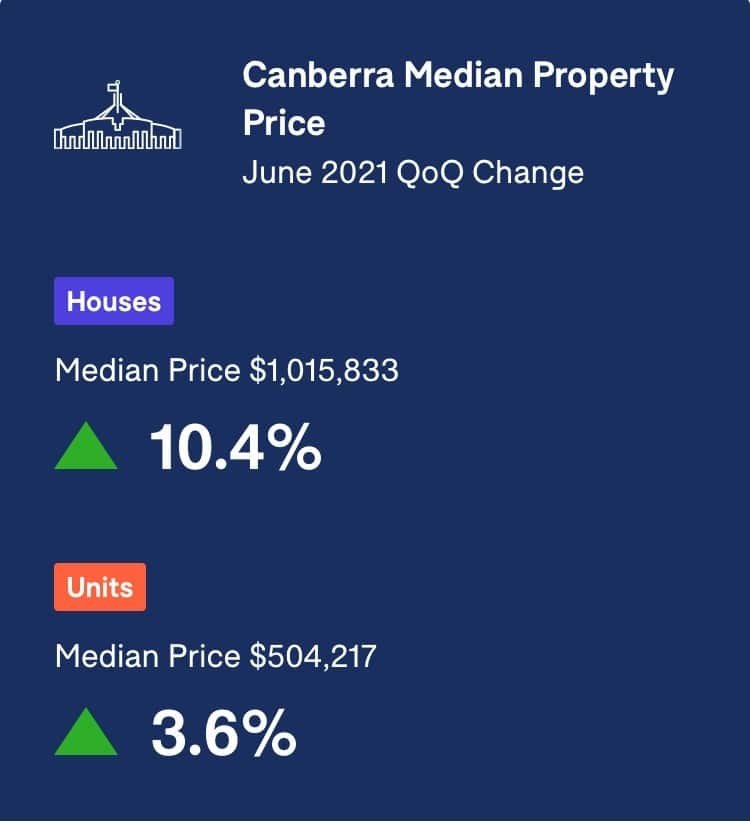

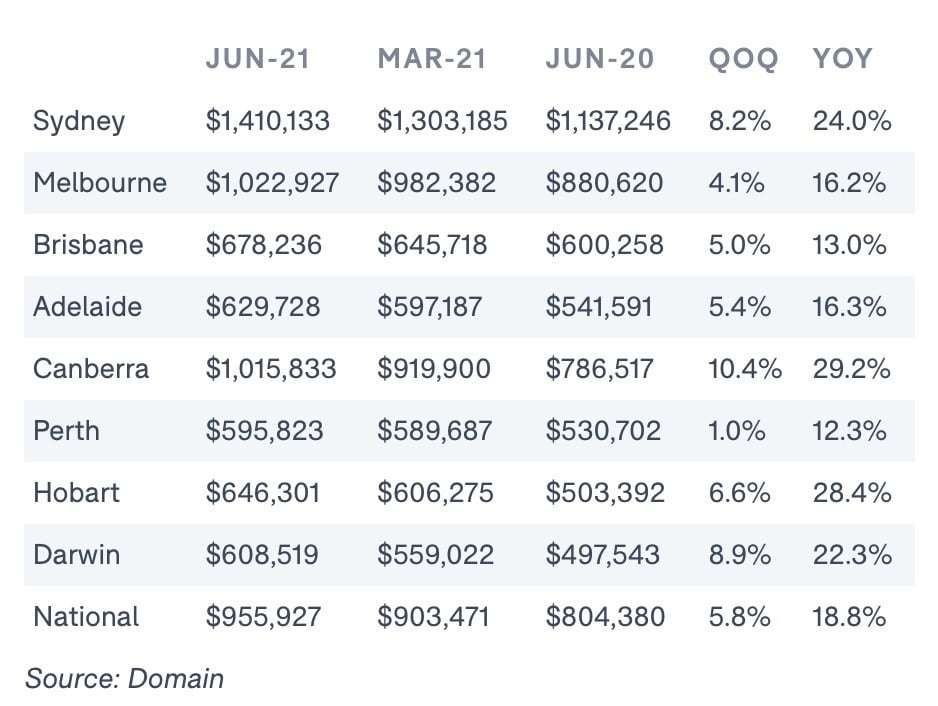

The median prices of homes in Canberra increased by 29.2% year on year and by 10.4% in the last quarter to achieve a new average sale price of $1,015,833. “This is the steepest price acceleration in almost three decades. Median house prices in the inner north, inner south and Woden Valley are above seven-digits” according to Dr Nicola Powell Chief of Research and Economics at Domain.

Source: Domain

The skyrocketing rate of house prices in Canberra places it firmly amid premium-priced capital cities like Sydney and Melbourne, making Perth the new go-to for affordable houses in an Australian capital city.

The price of units in Canberra achieved a median sale price of $504,217, recording the most substantial increase compared to the other capital cities: an increase of 3.6% for the quarter and 4.7% for the year. The median price of units in Canberra has grown at a slower pace compared to houses, but does represent an equity win for investors and owners who have also benefited from the lower costs of acquisition, especially if it was their first home or investment purchase.

The race to the multi-million dollar club by Canberra, Sydney and Melbourne is currently being fuelled by a unique set of circumstances, according to Dr Powell:

“The unusual circumstances over the past 12 months is the focus that’s been placed on our homes: we are spending more time in our homes than ever before and spending less [money]. We are using our homes differently. Using increased savings to pay debt can give people more buying power, and for anyone with an increased rate of savings, it’s just collecting dust, so

we are seeing people pay down debt or upgrade their homes.”

There are additional factors that are the driving force behind the surge in Canberra’s median house price. These include a sizeable number of public sector employees – some of which have migrated from other Australian states – and the fact that they earn a larger than average income.

Buyer demand remains high for property in Canberra. Clearance rates were above 88%, and Canberra achieved the highest clearance rates in 21 weeks of 2021, compared to the other capital cities. 127% more auctions scheduled in June compared to the 10 year June average, but demand continues to outstrip supply given that the number of homes for sale is averaging a multi-year dip.

The median price of a house in an Australian capital city is $955,927, up from $804,380. There is concern that homeownership is becoming too far out of reach for the average first-home buyer, without substantial Government incentives or by lowering the minimum deposit requirements. This eye-watering new median price gave rise to calls by some; to further intervene on behalf of buyers who are priced out of buying a stand-alone.

The CEO of Domain – Jason Pellegrino – mentioned that a subtle trend appeared to be emerging in the quarterly data.

He observed that;

“Nationally we have seen the rate of quarterly growth subtly moderate. It is hard to confirm if this is seasonal impact with the prior corresponding period being impacted by COVID-19, but it could also be a signal that the property markets in our most populous states have reached a price growth peak and we may be moving toward more moderate growth”.

The experts predicted a slow down in price increases by 2022-2023 since the current surge in prices is likely to be unsustainable over the longer term. Westpac has predicted that lending policy will be tightened as prices become increasingly more unaffordable and, the RBA eventually delivers on the promised rate rises.

If these trends do play out in the way that the banks and property experts have predicted, then prices will probably continue to increase at a slower rate. Investors and owners of houses in Canberra will continue to see an uptick of equity as the race to the multi-million dollar club pushes on.

Contact Trilogy to claim your free 30-minute finance strategy session. If you would like assistance with buying an investment property before the prices rise even further, we can help you strategically build and grow your property portfolio. There are still lots of wins to be had in this property market when you have the right broker on your team.