Knowing where and when to purchase an investment property is one of the hardest skills to master. A high-performing property must satisfy a wide range of criteria specific to your current and desired situation, and its characteristics (ie. Growth vs. yield, gearing strategy) must fit logically into your current portfolio, too.

One of the most common questions we’re asked by our clients revolves around the physical location of high-performing properties. Interestingly, to the surprise of many, Canberra is increasingly becoming a viable option.

In this article, I explore some of the key reasons why you might want to consider a Canberra suburb as a viable choice for your next investment property. A combination of steady population growth and positive demographic qualities, strong rental yield, the potential of a price upswing, and other compelling reasons are creating lucrative investment opportunities right across our colourful Bush Capital.

And as always, please note that this article is general information only. It does not take your unique situation and goals into account. Before you make any decisions about your property investment journey, speak to a qualified professional.

Canberra’s Population Growth

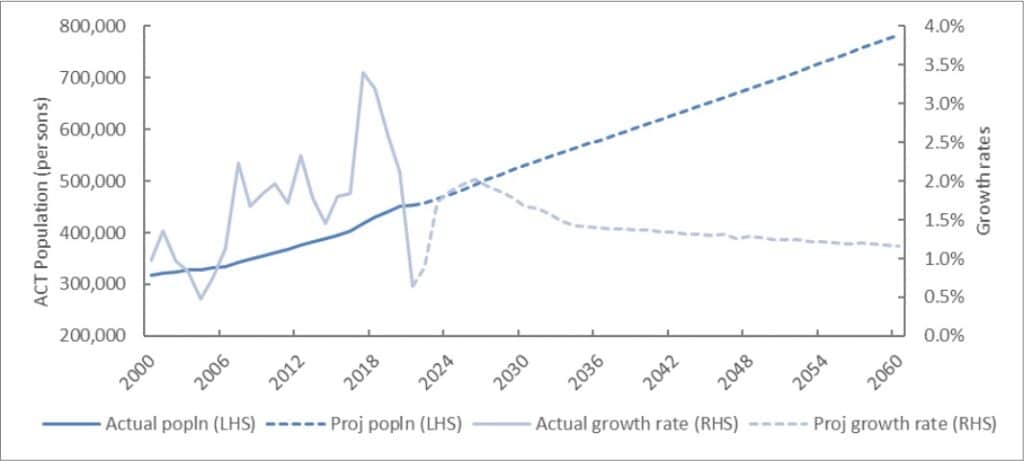

Analysing Canberra’s population growth provides insights for potential investors. A report recently released by the ACT Government suggests that Canberra’s population is likely to grow from 453,558 persons in June 2021 to 784,043 persons in June 2060—representing a growth rate of 1.4% over the 39-year timeframe.

Naturally, this population growth will require housing—therefore demonstrating compelling potential for property investors and developers.

Canberra’s Demographic Profile

Analysing Canberra’s demographics can provide insights for potential investors, too.

As per the Australian Bureau of Statistics:

- More than half of Canberrans have a Bachelor Degree or above

- 18.9% of Canberrans are employed in a governmental role

- 7.7% of Canberrans are employed in a defence role

And many others are employed in other public service roles. Additionally, according to the Australian Bureau of Statistics, the average median weekly income of a Canberran is $1289, one of the highest incomes in Australia.

This abundance of educated public servants, with higher-than-average incomes, creates a base of high-quality potential tenants.

Canberra’s Educational Institutions

Canberra is home to several renowned universities such as:

- The Australian National University (ANU) – A world-standard, multi-disciplinary university closely linked with the Australian government and the Australian Defence Force (ADF).

- University of Canberra (UC) – UC is a modern university that offers undergraduate and postgraduate degrees across a range of disciplines, including health, education, science, engineering, and business.

- Canberra Institute of Technology (CIT) – CIT is a vocational education and training provider that offers a range of courses across a range of disciplines, including business, hospitality, creative arts, and trades.

- Australian Catholic University (ACU) – ACU is a national university that offers undergraduate and postgraduate degrees across a range of disciplines, including education, health sciences, social sciences, and theology.

- UNSW Canberra – UNSW Canberra is a campus of the University of New South Wales, featuring science, engineering, and business campuses.

These institutions attract both domestic and international students, creating a steady demand for rental properties. Additionally, in our post-COVID environment, students returning to Canberra could add $400M to the ACT’s economy over the next two years.

An influx of students may put pressure on rental property supply and create attractive conditions for investors.

Rising Rental Yields

According to this article from Australian Property Investor, Canberra’s gross rental yields have increased by 0.37% over the past 12 months to 4.19%. This exceeds Melbourne’s yield of 3.4% and Sydney’s yield of 3.22%.

A high rental yield is good news for investors. Generally speaking, higher yields can lead to the faster repayment of loans, thus accelerating wealth creation plans.

A Changing Reputation, And Potential Price Upswing

For a while there, Canberra had a reputation of being the nation’s most expensive city to rent in. However, this changed recently after Canberra reported a decline in rental prices over the last quarter. This may be a welcome sign to renters considering a move to Canberra, thus increasing demand for rental properties.

It’s important to address the recent 8.1% decline in Canberra’s property prices over the previous 12 months. In the short term, a decline in value is undesirable. However, new investors may see this as an opportunity to ‘buy in the downswing’.

Is Canberra A Good Place To Buy Investment Property?

Canberra is a great place to live, and its population is educated and earns good money. Rental yields are increasing, broader property values may be due for an upswing, and an increasing population will place pressure on available properties. Does this mean Canberra is a good place to buy investment property? It depends. Canberra’s statistics are moving in a positive direction, and the Bush Capital is catching the eye of savvy investors looking for alternatives to the usual haunts in Sydney, Melbourne, and other regional centres.

However, an investment property that’s great for one person, might not be so good for someone else. As always, seek professional advice before making any decisions.

Can We Help With Your Property Investment Journey?

If you’re like many mortgage holders, you might be experiencing the pinch of rising interest rates. This means it’s even more important to review your current loan and lending structure to ensure you’re not overpaying.

If you’re looking for an expert team to help with your property journey, or you’re looking for a mortgage broker in Canberra, request a 30-Minute Finance Strategy Session during which you will…

- Learn more about Canberra’s property market, and some possible options available to you (please note, we will refer you to an external property selection specialist)

- Get a better understanding of the lending options available to you, so you can buy or refinance with confidence

- Discover no-cost ways to save money on interest, fees, and charges

- Get an up-to-date picture of the lending landscape including rates, conditions, and how to structure loans

- Learn about our process to find you a better loan that could save you thousands.

This no-obligation session will be held with one of our experienced mortgage brokers.

Please be assured this will not be a thinly disguised sales presentation. On the contrary, you’ll receive our best strategic advice, specific to your situation, so you too can accumulate multiple properties without sacrificing your current lifestyle and accelerate your progress towards wealth.

Schedule Your FREE 30-Minute Finance Strategy Session Today

Please note, the numbers and assumptions listed in this article are for educational purposes only. Individuals should seek specific advice pertaining to their unique situation and the real estate market before making any decisions.

Trilogy Funding Two is a corporate credit representative (Representative Number 506131) of BLSSA Pty Ltd, ACN 117 651 760 (Australian Credit Licence 391237)