New property listings fell by 22.2 per cent in Canberra during June 2021 and by 9.1% on average across the country. The demand from buyers remains high and even older listings – that had been stagnant on the market – have also been snapped up.

The Deputy Governor of the Reserve bank, Guy Debelle said “…ultra-low interest rates were…boosting house prices” but Federal Treasurer Josh Frydenberg acknowledges that “…obviously, there is both a supply and demand side to this equation”.

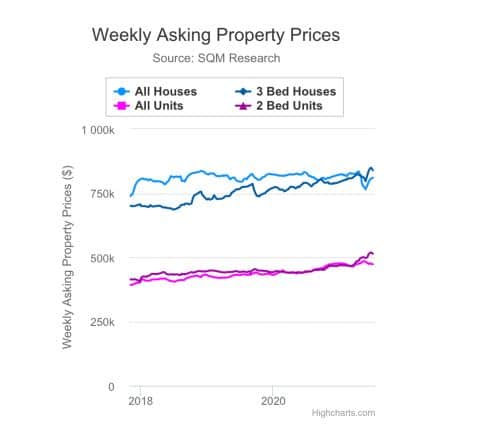

“As demand outstrips supply, we are seeing strong rises in asking property prices, in capital cities and the regions, which is likely to continue through 2021,” says the managing director of SQM Research

According to CoreLogic’s Pain and Gain report, 90.3% of houses sold in the March 2021 quarter achieved a profit for the reseller. This represents a 4.3% increase from June 2020. These types of results are very attractive to homeowners who have thought about selling their homes, bolstered by the confidence that they can pocket a hefty profit from the sale. Westpac research found that 39% of Australian homeowners plan to list their properties for sale in the next five years.

However, Westpac’s predictive modelling estimates that 1% to 5% of the property stock will be listed in the major cities in the next 6 months. The disparity between the number of owners who would like to sell compared to those who are likely to list in the next 6 months may be attributed to replacement costs.

These replacement costs are creating a “housing gridlock…for many potential sellers who think they’ll struggle to find the right home – and beat the intense competition for it – once they’ve sold… they mightn’t have enough to buy the house they really want to upgrade into” according to Domain’s senior research analyst Nicola Powell.

The average asking price for a house in Canberra increased by 4.8% in the week ending June 29 and by 10.4% across the Australian Capital cities combined. Those owners -who are seeking larger or more premium properties – fear being priced out of buying a new property after their home is sold. Upgraders may instead opt to renovate and stay put in the meantime.

Alternatively, down-sizers feel more confident that they will be able to find and afford their ideal down-sizer property after selling and buying in this market.

26% of respondents – in the national Finder survey – believe that the final selling price of a home is likely to be higher than 11% to 20% of the listing price. There are a few recent examples of property listings that have smashed through the advertised listing price, and these success stories might be fuelling these beliefs. At the start of July, a Chatswood home sold for $620,000 over reserve in an online auction and, a renovated home sold for $450,000 over the price guide in Lane Cove West

Even homeowners who had previously considered selling their property, and renting another while building their new home, are thinking twice as rents continue to rise. Canberra has the most expensive average rent compared to the other capital cities, with the average rent for units sitting at $500.70 and $710.90 for homes.

When you combine this surge in rental prices with vacancy rates that are their lowest since 2018, potential sellers fear that they may struggle to secure a rental property without blowing through much of their profits while waiting on a new build.

The type and quality of the homes that are eventually listed for sale will be significant from the perspective of property supply. In a booming market, the least desirable properties – just like the sinking house that sold for $440K above reserve – will sell. However, in a cooling market – where buyers are spoilt for choice – and assuming that interest rates remain at historically low levels, a price correction is likely but not guaranteed.

If 1% to 5% of owners do indeed follow through and list their property in the next six months, it will be a welcome and much- needed boost in supply. In addition to supply, factors such as interest rates, lending standards and pandemic recovery will also play a role in determining whether prices will level out over the medium term.

The property professionals at Trilogy offer a free 30-minute finance strategy session for new and existing investors. We can help you build and grow your property portfolio even in an extremely competitive property market.