For decades, Australians have understood the benefits of home ownership. Owning a “Primary Place Of Residence” (“PPOR”, AKA your castle) unlocks doors to wealth and personal fulfilment. Many Australians also understand the benefits of investing in more than one property.

However, sometimes the semantics—or timing—of purchasing more than one property can be confusing. Some of the questions we’re asked by new clients are:

“Should I pay off my home before I invest in a second property?”

Or…

“Isn’t it counterintuitive to pay off two loans at once? Don’t I ‘go broke ’paying too much interest?”

These are great questions. In this article, I’ll answer these questions by examining the numbers from two different scenarios, namely:

- Paying off a family home before investing in a second property, and

- Paying off a family home whilst simultaneously investing in a second property.

The findings might come as a bit of shock…

Scenario 1:

Paying Off A Family Home Before Investing In A Second Property

This first scenario is the situation many Australians find themselves in: paying down a principal and interest loan in its entirety, over a 20-30 year period.

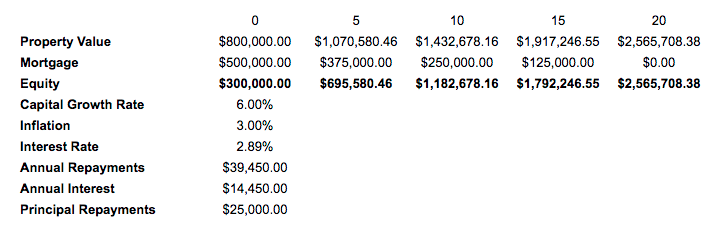

Let’s say we have a couple who own their own home, with 20 years remaining on the mortgage:

- Home Value: $800,000

- Mortgage Balance: $500,000

- Term: 20 Year Term remaining

- Interest rate: 2.89%

- Repayments: $3,287

- Annual Capital Growth: 6%

Here’s a timeline, from left to right, showing their financial journey as they pay down the loan:

As you can see in the first scenario, the couple will continue paying down their loan over its lifetime, and after 20 years are left with a ‘paid off’ family home valued at $2,565,708.

The home is completely free of debt, thanks to paying down both principal and interest, and has significantly grown in value.

Scenario 2:

Paying Off A Family Home Whilst Simultaneously Investing In A Second Property

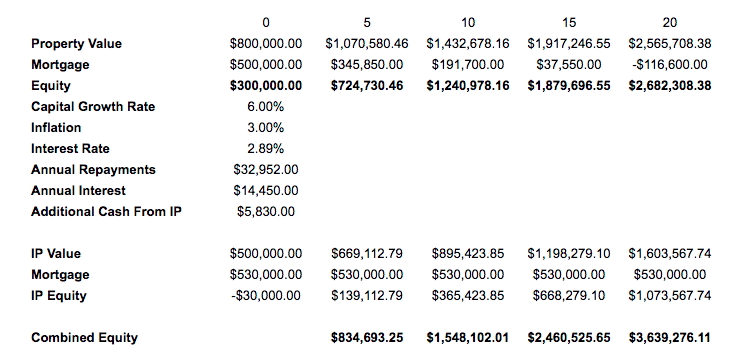

Let’s say the same couple decide to use the equity in their family home to buy a second property. The loan covered the purchase costs and the entire value of the property.

The couple chose to go with an interest-only loan and use the spare cash being generated from the investment property to help pay down the mortgage faster.

In this example we make the following assumptions:

- Home Value: $800,000

- Mortgage Balance: $500,000

- Term: 20 Year Term remaining

- Interest rate: 2.89%

- Repayments: $3,287

- Annual Capital Growth: 6%

Then we also add in the following metrics for their investment property:

- Investment Property Value: $500,000

- Mortgage Balance: $530,000

- Term: 30 year term, with 5 years interest only

- Interest Rate: 3.70%

- Repayments: $1,635 (interest only)

- Rental Income: $1,950 ($450 pw)

- Cash flow: $315 pm (less agent fees etc)

- Expected Capital Growth: 6%

The results are significant, to say the least. Here’s their journey over time, from left to right:

Note: Given that the investment property is on an interest-only loan it is generally going to be higher than a standard P&I loan. We have also assumed there is no growth in rent, which would likely offset additional costs over time.

Which Scenario is Best?

As we can see in this example, if the couple chooses to invest at the same time as paying off their mortgage, they will be in a far better financial position in 20 years’ time.

Not only will the investment property generate cash flow to help pay down the mortgage on the couple’s family home, but the owners can benefit from the capital growth.

Outcome: The Second Scenario Creates Valuable Cash-Flow

Cash flow generated from the second property is used to pay down their mortgage, which means they are able to clear their debt faster. They are mortgage-free after 16 years, allowing them to hold onto their mortgage repayments for approx. four additional years.

Outcome: The Second Scenario Creates A Growth In Equity

Under scenario 1, capital growth saw their family home grow in value to around $2.5 million. While this is impressive, when combined with an investment property this number gets even better.

Thanks to paying down their mortgage faster, the couple’s equity in their family home jumps to $2,682,308 by the end of the 20 year period.

They’ve also managed to save around $160,000 in mortgage payments because they paid off their home faster with the help of the cash flow from the investment property.

However, the real benefit is capital growth in the investment property. While the couple has only been paying down interest over the life of the loan, equity in the property has increased significantly to $1,073,567.

That’s over $1 million extra they are going to have when they retire…

Conclusion

In almost all situations, it’s going to be far more beneficial over a long period of time to not only pay down a mortgage on your family home but to also invest in another property*.

Investing in a second property has a range of benefits. Firstly, the investment property will likely grow in value significantly over time. Also, depending on where you invest and the underlying level of interest rates, it’s likely that you will be able to generate cash flow from your investment property.

Finally, there may be a number of tax benefits you can receive on an investment property that may not exist on a family home. For the sake of simplicity, we haven’t included those considerations.

Clearly, there are some significant financial benefits to both buying a family home and investing at the same time. The reality of the situation is, the sooner you start investing, the more time you have on your side, which will ultimately put you in a far stronger financial position in the long run.

*Earnings Disclaimer

Please note, the numbers and assumptions listed in this article are for educational purposes only. They are not a promise of performance. These results are not guaranteed. Individuals should seek specific advice pertaining to their unique situation and the real estate market before making any decisions.

Trilogy Funding Two is a corporate credit representative (Representative Number 506131) of BLSSA Pty Ltd, ACN 117 651 760 (Australian Credit Licence 391237)