The Canberra property market has beaten out stiff competition from other Australian capital cities – including the harbour city- to record the highest growth for house prices in the first quarter of this year.

In the first quarter of 2021, Canberra sale prices have broken through the median $900,000 mark to reach over $927,000 for houses, and to achieve the eye-watering new record of a 9.7% gain in price.

There is even more great news for owners and investors of houses in Canberra. House prices have enjoyed their sharpest annual rise in almost 20 years with over 19% in growth on an annual basis. Some areas have even topped a median price over $1m (namely Woden Valley, North and South Canberra).

This record-breaking market update is tempered by a 5% drop in the market for units to an average of $473,000 in the last quarter. However – even with this decline in the price of apartments – the market for units in Canberra is still 2.7% higher than it was during this period in 2020.

What does this mean for investors?

Canberra is still conside

red to be a “property unicorn”. It generates a strong rental yield while still offering affordable price points and capital gains that are likely to build wealth over time.

Depending on their overall investment strategy, a slight dip in the price of Canberra units coupled with prices that have risen over time, in general, may still present a smart buy for some investors. Especially when they take into account that average rents for units have increased by 4.2% in the past quarter to $500, vacancy rates have dropped to 0.7% and the number of vacant rentals is 14% less than the year prior. Compare this to buying an apartment in the Sydney market – with a median price of $750,000 – and receiving rents of $30 less than in Canberra on average.

The rent for houses has also gone up to $600 in the last quarter, representing a 3.4% increase in rents. Coupled with the record-breaking gain in the prices of houses detailed above, property investors are chomping at the bit to get into Canberra houses.

What’s behind Canberra’s Record-Breaking House Prices?

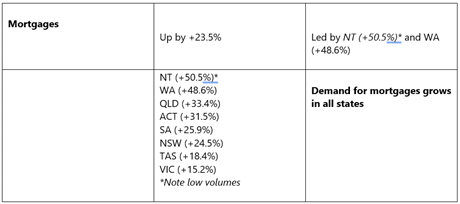

The surge in the price of Canberra’s houses can be – in large part – attributed to record-low mortgage rates and a spike in new home loan approvals. More than $28 billion or 12% more loans than December were given out in Australia at the start of this quarter and, there was also a 23.5% increase in the demand for mortgages compared to the same time last year.

Low interest rates usually also mean lower mortgage repayments therefore homeowners and investors in Canberra – and in all Australian states – are rushing in to get a better deal from their lenders.

Via: Equifax

When there are rock bottom interest rates, a surge in lending and a shortage of houses for sale: it is not uncommon to see a steep hike in the price that most buyers are willing to pay. Canberra’s auction clearance rates surpassed all its previous records to hit 89% in March and really illustrated that buyers are not being turned off by the higher prices or the intense competition for the small number of houses that are currently on the market. They just do not want to miss out.

The Governor of the RBA has also boosted consumer confidence with assurances that the board did not foresee the need to increase the cash rate in the next 3 years, since the rates were dropped to a tiny 0.10%

But the recent “run on the market” evidenced by skyrocketing house prices, soaring demand for home loans and property bidding wars tell us that most buyers suspect that interest rates may not stay this low for the next three years. Or they at least suspect that other measures – like lending restrictions – may be taken to slow down this recent

boom.

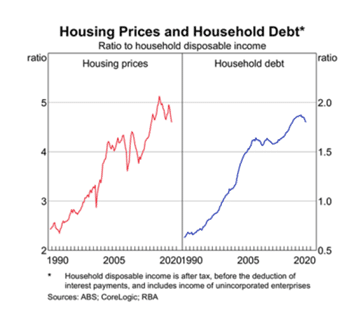

At the AFR banking summit in March 2021, the APRA chair Wayne Byres asserted that “The goal is to sustain a balance that allows good quality customers to obtain a sensible amount of credit in a timely manner”. He also added that APRA is not mandated to act on house prices but rather that one of the key metrics – amongst others – they do monitor is the rate at which household debt tracks against income.

Do you Need to Review your Mortgage?

Smart property homebuyers and investors understand that this climate of low-interest rates presents an amazing opportunity to grow their property portfolio. But they also understand that scoring the right mortgage at the best possible rates does require careful planning, especially when property prices are booming.

Affordability is an important factor and we can help you to calculate how much you can borrow to refinance your existing property or purchase your next investment property.

Contact us today for a free strategy session.