The CoreLogic regional market update reported that buyers around Australia are very eager to snap up properties in beautiful regional Australia. A desire for bigger dwellings, fresh air and larger blocks is an understandable side effect of the shift to our new normal.

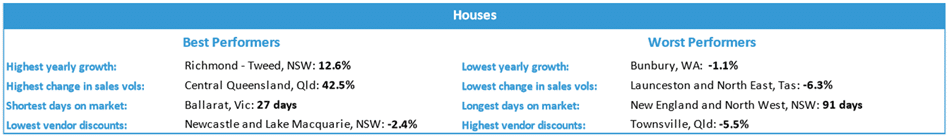

The Richmond-Tweed and the Southern Highlands / Shoalhaven market in NSW, claimed the top spots in the regional property price rise, with an annual growth of 12.6% for houses and 17.9% for units respectively.

The celebrity playground of Byron Bay recorded a 26% increase in median prices to $1.15 million, followed by Parkes with a 24.1% rise to $335,000 and Kiama with 20% to $1.02 million.

Regional House Markets – January 2021

Regional Unit Markets – January 2021

Source: CoreLogic

Sydney flight to regional areas has also bumped up the cost of regional rentals by 7%. City slickers are driving the demand for regional properties in a market with a very small pool of available dwellings. The Tweed shire council has declared a housing emergency to address an absence of affordable housing in the region since many of the locals can no longer afford the rising prices even in dual-income households.

The Rise in Regional Property Prices is Likely to Continue

More Australians said goodbye to capital cities in quarter one to quarter three of 2020 than any other period on record in the last 20 years. This phenomenon has been described as one of the biggest property trends of the 21st century.

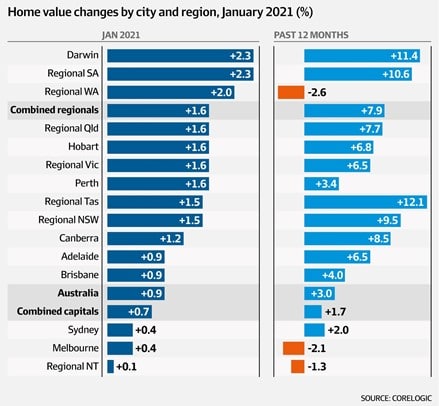

Although regional prices, in general, rose by over 6% in the December quarter, the average prices of properties in regional Australia are still more affordable than similar properties in a capital city.

Tim Lawless – Executive Director of Research at CoreLogic – stated that the rise in the popularity of regional property is expected to continue to a certain extent. Affordability , lower density in housing and flexible work arrangement being the primary drivers of this popularity.

Regional properties with proximity to capital cities or major cities are also likely to continue to grow in price. The evolution of the work from home (WFH) office worker has given many employees the flexibility to prioritise lifestyle over living near their work. Regional towns that offer an easy commute to the major cities will still be favoured by those workers who work on a hybrid WFH model and still need to be onsite a couple of days a week. Given that WFH productivity was high during the lockdowns and, the rapid developments in workplace technology, it is reasonable to assume that WFH or similar arrangements will remain a viable option for the years to come.

‘Out-of-town’ investors are even drawn to larger country towns that have a longer commute to Sydney or Brisbane if they have ample infrastructure and facilities like in Tamworth. As the heartland of Australian Country music and equine events, Tamworth offers a great portfolio opportunity for investors who have, for the last 12 months, snapped up so many properties that prices have risen and the rental stock has begun to dwindle.

Is it Harder to Buy Property in Regional Australia?

Buying property in regional Australia is different to buying in major cities in some ways. The 5 key differences to be aware of and prepare for are proximity to major centres, access to infrastructure like health care, family-friendly amenities including childcare centres, that prices are too good for a nefarious reason and that your bank will also be influenced by the population size of the regional town and their exposure in that market, when making their lending decisions.

The regional Australian property market has experienced a resurgence in prices over the last year. After extended periods of decreasing prices due to downturns in the mining industry, devastating droughts and low wages compared to capital cities, young Australian families and investors are starting to fall in love with country towns again.

The success of the WFH model in 2020 gave more employees the option to keep their high paying jobs in capital cities, while still being able to locate to regional towns that complement the lifestyle they want for themselves or their families. Investors have also been quick to pick up on this trend and are rushing in to capitalise on the affordable property prices and, the rental yields that are difficult to replicate in the major cities.

Want to find out more about buying or investing in regional Australia? Call Trilogy on 1300 657 132 today to find out how much you can borrow and how you can avoid missing out on the trend toward regional property investment.

Buying property in regional Australia is different to buying in major cities in some ways. The 5 key differences to be aware of and prepare for are proximity to major centres, access to infrastructure like health care, family-friendly amenities including childcare centres, that prices are too good for a nefarious reason and that your bank will also be influenced by the population size of the regional town and their exposure in that market, when making their lending decisions.

The regional Australian property market has experienced a resurgence in prices over the last year. After extended periods of decreasing prices due to downturns in the mining industry, devastating droughts and low wages compared to capital cities, young Australian families and investors are starting to fall in love with country towns again.

The success of the WFH model in 2020 gave more employees the option to keep their high paying jobs in capital cities, while still being able to locate to regional towns that complement the lifestyle they want for themselves or their families. Investors have also been quick to pick up on this trend and are rushing in to capitalise on the affordable property prices and, the rental yields that are difficult to replicate in the major cities.

Want to find out more about buying or investing in regional Australia? Call Trilogy on 1300 657 132 today to find out how much you can borrow and how you can avoid missing out on the trend toward regional property investment.