The 2021-2022 Federal Budget was recently handed down by the Federal Treasurer Josh Frydenberg. “The Real Estate Institute of Australia (REIA) said the 2021 Federal Budget confirmed a positive outlook for buyers, sellers, investors, tenants and small business”.

First home buyers, single parents and mature age homeowners were granted assistance in targeted programs that are engineered to work together with the other sections of the budget to strengthen the Australian economy.

At first glance, there doesn’t appear to be any obvious big wins for property investors in this recent budget. However, there are significant benefits to be gained by investors who can align their investment strategy with the goal of economic recovery and growth that the budget seeks to achieve.

- No changes to the main Investment Property Taxes

There was an almost audible collective sigh of relief from Australian property investors when the budget revealed negative gearing and capital gains will remain unchanged. Keeping the current arrangements in place – for the moment at least – will go a long way to boost confidence by promoting consistency and stability for investors. It will also offer a measure of predictability for those who wish to grow their property portfolio.

- The Value of Existing Homes will be Protected

The targeted deposit schemes will help first home buyers and single parents to overcome one of the biggest hurdles to entering the Australian property market.

- New Family Home Guarantee for Single Parents

Under this scheme up to 10,000 single parents can purchase a home with a deposit as small as 2%.

- New Home Guarantee

This guarantee extends the first home loan deposit scheme (FHLDS) for a second year and has added 10,000 more places for first home buyers to get their new home with a deposit of only 5%.

- First Home Super Saver

This budget item expands on the original program – introduced in 2017- and now allows first home buyers to withdraw up to $50,000 from their voluntary super savings. This amount has previously been capped at $30,000.

The approach taken to homeownership support through precise deposit schemes will help more Australians gain access to the property market, but will also endeavour to protect the value of homes for existing owners through the price stimulus that these incentives will create in the market.

This is particularly positive news for property investors who leverage the equity in one investment to purchase the next or investors who rely upon the natural growth of property values to grow their net worth over time.

- Better Regional Infrastructure means Better Regional Property Investment Opportunities

The budget asserts that “the Government is providing $348 million to further enhance the attractiveness of regional Australia as a place to live and work.”

This budget allocation will include $250 million for the development of regional infrastructure projects, $84 million to support improved digital connectivity, $6 million to rebuild regional communities as they recover from the impacts of COVID-19 and over half a million to studies that aim to uncover the barriers for business relocation to regional Australia.

Many innovative property investors are already flocking to regional Australia for their next deal. The blocks are bigger and the prices are trending upwards again. The 2021 budget is likely to boost investor confidence in the opportunities that regional real estate can offer in terms of capital growth and cash flow properties.

- Downsizer Incentives will free up Housing Stock

The downsizer contribution minimum access age will be lowered from 65 to 60 years old from 1 July 2022. Australians who are approaching retirement age will be able to make a post-tax contribution of up to $300,000 each after selling their family home.

In a climate where there is a high demand for housing and a low supply of suitable available properties, then freeing up housing supplies becomes just as important as building new residences.

The housing shortage combined with record low rental vacancy rates – not seen since February 2013 – will ideally be mitigated by the targeted downsizer scheme.

As a supply of previously tightly held properties begins to hit the market, the redevelopment of these family homes by innovative property investors is inevitable. Investors – with an aligning property strategy – will be uniquely positioned to repurpose these established properties for the young and modern families who are seeking out a forever home. While the mature age downsizers will seek out well-appointed, low maintenance homes that will allow them to retire with dignity and in comfort.

- Tax Offsets for Low and Middle-Income Earners

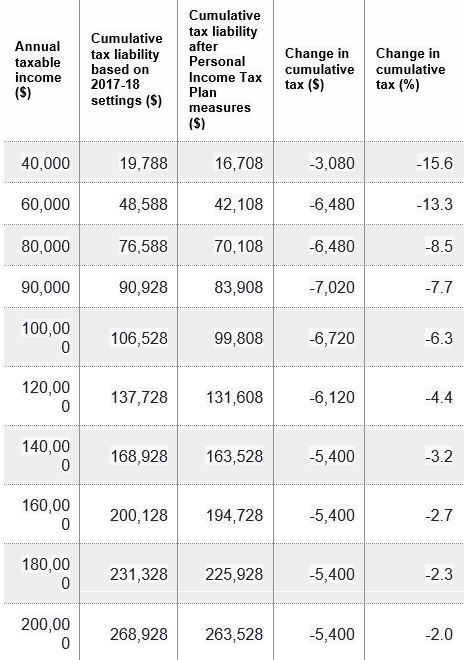

The data shows that most property investors are average hard-working Australians who make a working-class income. The tax offsets will benefit property investors by allowing for a further reduction of tax liability. After claiming the usual depreciation and rental property expenses, many investors will also be able to claim the low and middle-income tax offset.

Table 1: Cumulative tax relief for a single individual over the four years from 2018‑19 to 2021‑22*

Source: Budget.gov

A tax rebate of up to $1,080 for singles and $2,160 for couples is on offer if you earn less than $66,667 for low-income earners and, $126,000 for middle-income earners. The rebate operates on a sliding scale from $255 to $1,080 depending upon your assessable income.

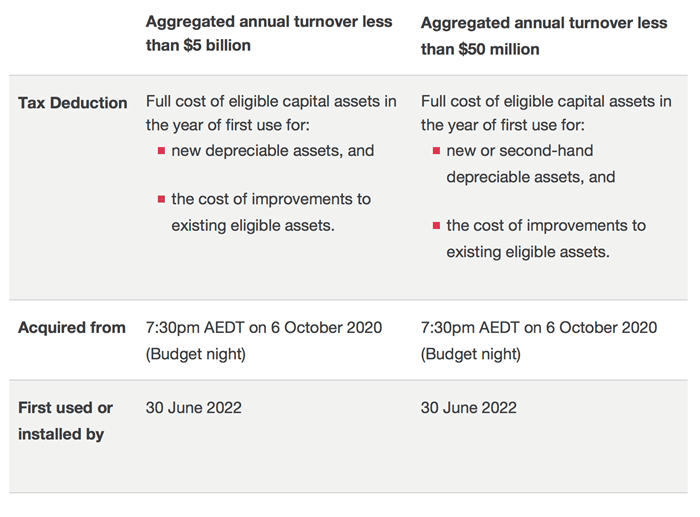

- Extending and Supercharging the Small Business Instant Asset Write Off

Until 30 June 2023 small businesses – with a turnover under $5 billion – can claim an immediate deduction in the same year for the business-use portion of an asset, rather than depreciating the cost over several years.

Source: PWC Australia

Property investors who own or rent their commercial premises may benefit from this supercharged write-off scheme by claiming an instant deduction for the cost of fit-outs, refurbishments and construction to their commercial property.

While at first glance it appears that property investors were not directly spotlighted in the 2021 Budget, the measures discussed above show that there are many advantages to be gained by investors who align their property strategy to recovery and growth.

A detailed property investment strategy with the Trilogy team can help you to map out the road ahead and give you powerful advice on how to leverage the 2021 budget benefits to supercharge your investment goals.

Book a free 30-minute strategy session now.