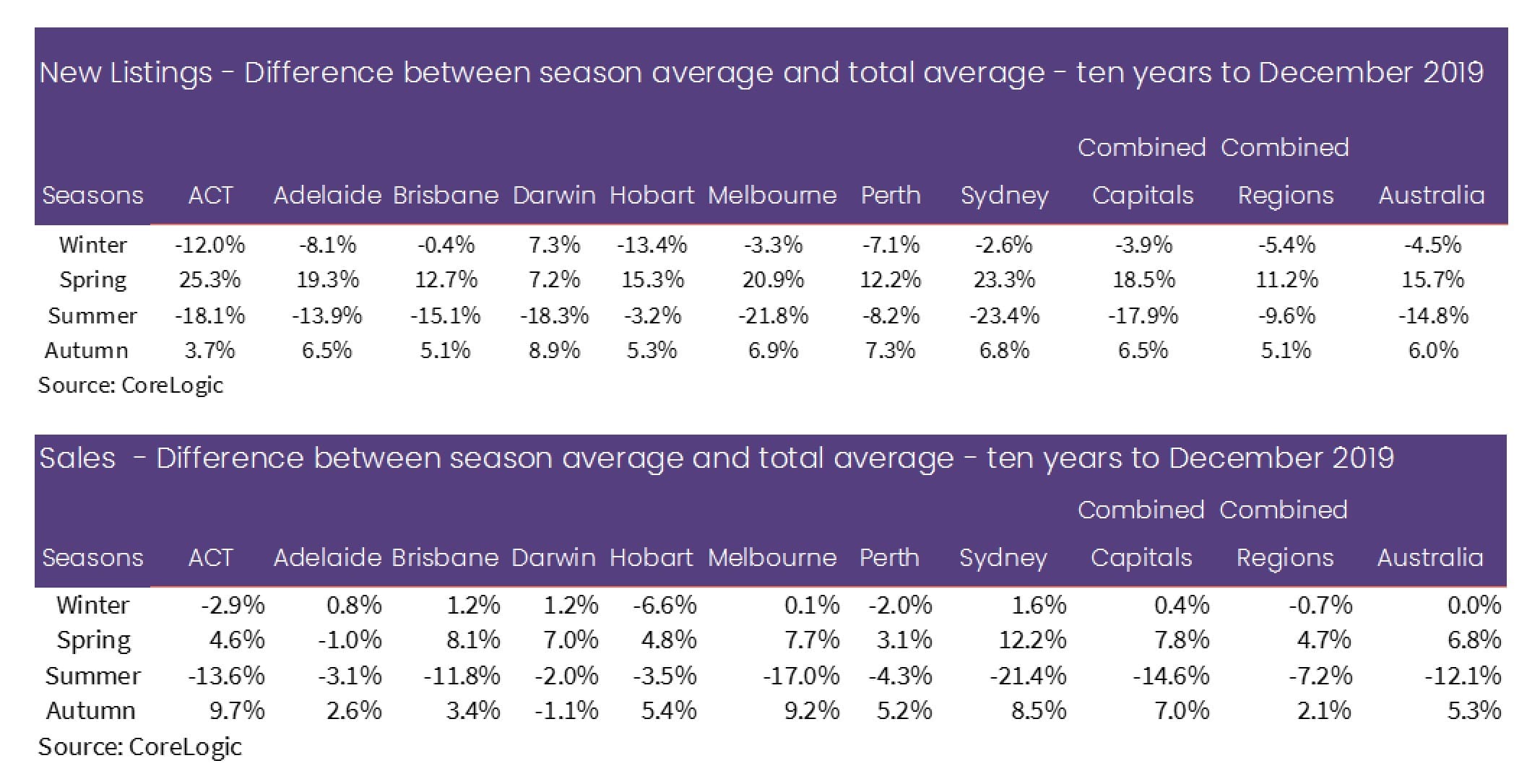

The spring buying or selling season – depending on which side you’re on – traditionally runs from the month of September to November of each year. In the ten years from 2009 to December 2019, the data indicates that property listings and sales are likely to jump up during the springtime. This upswing in real estate activity is strongest in the capital cities like Sydney and the ACT.

Greater Sydney, Canberra and Victoria remain under COVID-19 restrictions. We have learned from the lockdown listings and sales figures in 2020 and again during the ongoing Delta outbreak that, a drop in the market is to be expected. “ Limited housing stock available for sale combined with prolonged lockdowns in a number of states and territories has created difficult conditions for buyers”, according to the September REA insights report. This unique set of circumstances has created some uncertainty around how the spring buying season will pan out.

The property experts have put forward two key forecasts about what we might come to expect in the property market across the next few months.

The Spring Buying Season will be Delayed

Dr Nicola Powell – the chief of research and economics at Domain – suggests that the upswing of the traditional spring season will be delayed by the ongoing restrictions.

Dr Powell draws upon the extended Melbourne lockdowns in 2020 to support this forecast. During those lockdowns, listings and sales nose-dived at a rapid rate. When the state finally started opening up again, the property market recovered and quickly returned to normal.

“Once Canberra is out of lockdown and those restrictions, the market will bounce back quickly … one thing that can be learnt from other markets is that during this slow period, buyers are doing their research”, Dr Powell said.

However, Eliza Owen of CoreLogic referenced to the disparity in the clearance rates between Melbourne and Sydney- toward the second half of August – to indicate that the spring season may become a tale of two cities. A ban on in-person inspections in Melbourne severely impacted auctions with clearance rates plummeting to 49%, compared to Sydney with over 80% due one- on-one inspections going ahead during the lockdown.

Cameron Kusher at REA Group estimates that the spring season will start later this year for states still in lockdown and continue on into the new year.

“It is likely that the selling season will be delayed in NSW, Victoria and the ACT, and depending on the length of the lockdowns, it could push into later 2021 and/or early 2022”, Kusher said.

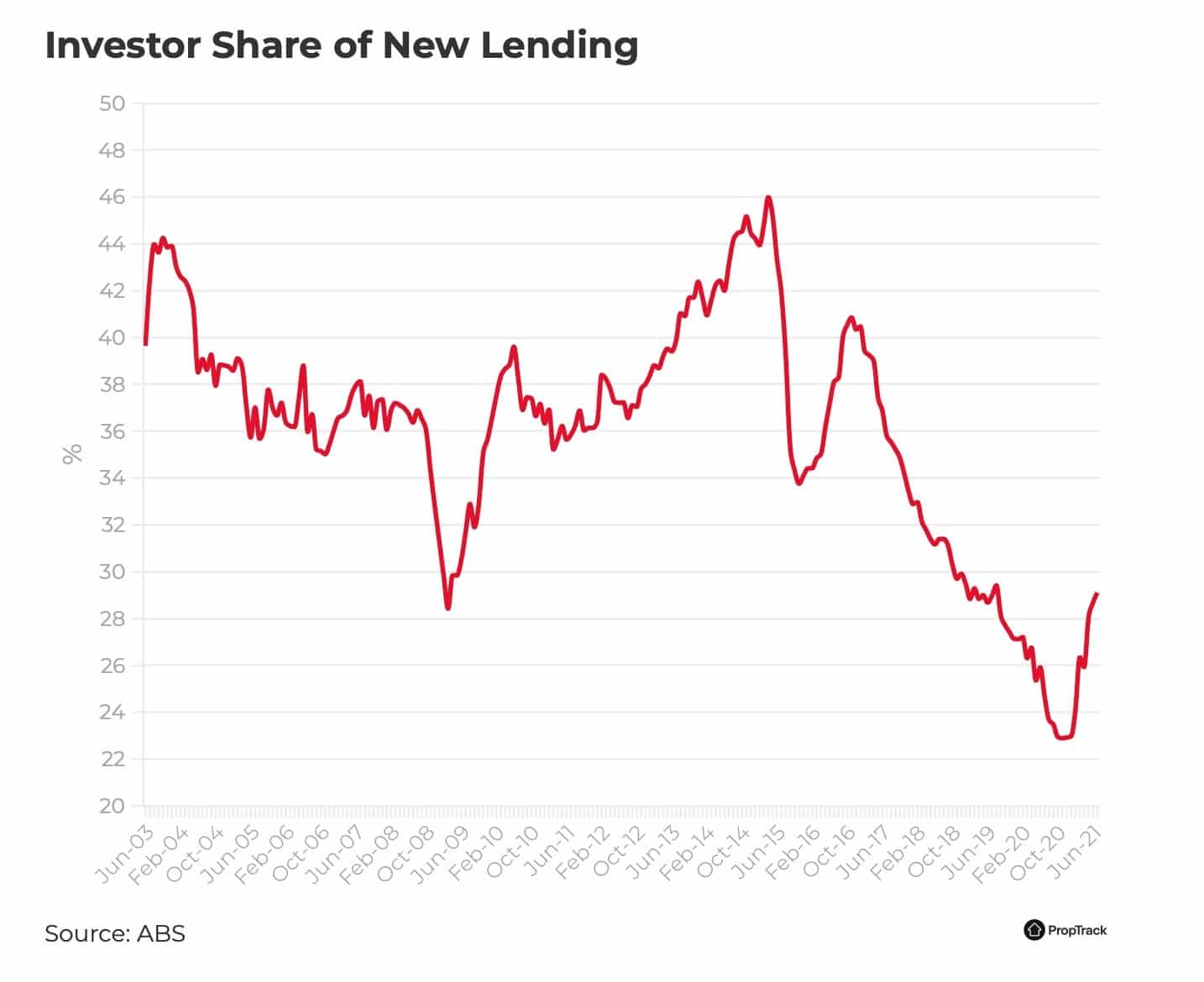

Property Investors will make a Big Comeback

New loans to investors increased from 23% in October 2020 to 29.4% in July. The new loans for investors have more than doubled during this period in the ACT, Queensland, Western Australia and the Northern Territory. However, investor lending has fallen in Victoria in June and July as the Delta case numbers surged.

Dr Michael Baumann – Executive General Manager of Home Buying at Commonwealth Bank (CBA) – asserts that a key motivator behind the investor resurgence is very low-interest rates that entice smart property investors looking to maximise the yield of their investment.

On the other hand, the number of first home buyers entering the property market plunged by 6.8% in July according to the Australian Bureau of Statistics. This drop is attributed to housing affordability according to the president of the Real Estate Institute of Australia (REIA), Adrian Kelly.

“Investors re-entering the market is a very good thing for private rentals and overall confidence in the economy; but the end of first home buyers housing stimulus programs introduced with the onset of the COVID-19 pandemic is a strong factor in these figures”, Mr Kelly said.

The annual busy season for the property market will look and feel considerably different this year compared to the last decade. Property experts seem to agree that the peak selling time will be delayed until the lockdowns are fully lifted and the market will potentially adjust to this delay by extending the spring buying season into 2022. The consensus appears to be that, the full volume of listings and sales will not be realised until the nation is closer to the road map to recovery or at least, onsite inspections can recommence.

The spring buying season is traditionally the ideal time to add new properties to your investment portfolio before the year comes to an end and, the property market goes into hibernation until well into the new year. Contact Trilogy today for a free 30-minute finance strategy session to find out how to plan a winning approach to the spring buying season.