While 2020 has seemingly placed all of humanity in a holding pattern of sorts, as we collectively “wait and see” what direction world events will push us in next, it’s important to remember that each of us has one infallible power right now; the power to choose how we respond.

Those who react from a place of fear will likely step off this roller coaster ride feeling a little green around the gills, mourning the various things they’ve lost along the way and uncertain as to where to begin, picking up the pieces of their life, post-pandemic.

However, those who manage to keep their wits about them, seeking solutions rather than attempting (in futility) to run from the “problem” and the general panic it’s inciting, could potentially come out the other side of this situation stronger than ever.

This too shall pass

Established property investors have a distinct financial advantage right now. The simple fact is, housing is, has always been and will continue to be, a necessary commodity.

Unlike the vast majority of stocks and shares, housing represents a basic human need. We all require shelter of some kind for survival. Hence, real estate has historically been the most enduring – and least volatile – asset class there is.

With a cultural and social emphasis on housing as the “Great Australian Dream”, property markets in Australia have been consistently robust; rebounding from any cyclical downturns with a continued growth trajectory. No matter the X-factors that exert temporary downward pressure on prices, be it fire, flood, (financial) famine and yes, even plague.

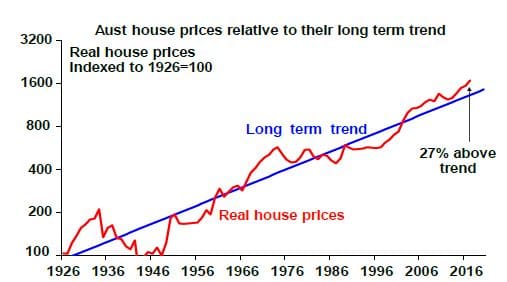

The below graph, depicting Australian house prices relative to their long term trend, clearly demonstrates an ongoing upward trajectory since 1926, prior to the Great Depression.

Source: ABS, AMP Capital

Interestingly, we can see from this graph that during the start of the Great Depression, house prices continued to outpace the long term growth trend, before being impacted significantly some 7 years into this period of economic upheaval, around 1936.

We also see clear evidence of a robust post-depression recovery, albeit in the following decade. But this has long been the nature of the beast when it comes to residential real estate.

Heck, you only need to reflect on how much your grandparents would have paid for an inner city dwelling in Melbourne or Sydney in the 1950’s or 60’s, versus how much you would pay for that same property now, to recognise that housing is arguably one of the most resilient and reliable investment vehicles going.

Expert predictions

There’s no denying property values and rents in particular, will be impacted by this latest X-factor to influence global economic markets.

Tourism and education will likely be the sectors that struggle most over coming months in Australia as our Chinese neighbours, who’ve long been voracious consumers of both, are effectively locked out of our country indefinitely.

And then there’s the unemployment rate, which is expected to soar from 5.2 per cent to double digits by mid-2020, possibly even hitting an eye-watering 20 per cent by the end of this year.

But given current circumstances, the general outlook from experts for economic recovery post-Coronavirus is promisingly optimistic.

Let’s face it, us Aussies are a resilient bunch. If there’s one thing we know how to do – and will be forced to do in the wake of these vast global changes – it’s innovate and create out of times of destruction and hardship.

In a statement to the House of Representatives Standing Committee on Economics, Reserve Bank of Australia Governor Phillip Lowe said, “It is too early to tell what the impact will be, but the SARS outbreak in 2003 may provide a guide.

“On that occasion, there was a sharp slowing in output growth in China for a few months, before a sharp bounce back as the outbreak was controlled and economic stimulus measures were introduced.”

University of NSW research fellow Nigel Stapledon said we cannot escape the inevitable economic fallout of the coronavirus outbreak, including a dampening of the housing market.

He noted that although the government will continue to churn out as much financial assistance as possible to keep the economic wheels turning (albeit groaningly slow), there are limits to the stimulus they can provide.

“There will be negative effects on employment. It will be a short, sharp shock to the economy,” he said.

“It’s important to remember the rebound will happen. People will recover. People will go back to restaurants. People will go to football games. Things will eventually bounce back. Things will go back to normal – eventually – but there will be some casualties along the way.”

Stapledon said although he expects a strong rebound for the housing market in 2021, “in the short term, it will hurt.”

There’s no denying housing values could take a substantial and rather immediate hit, as falling auction clearance rates suggest people are obviously reluctant to commit to a mortgage right now and demand is drying up.

However, investors who’ve planned for these types of contingencies and can keep their wits about them now, could potentially find further opportunities to grow and consolidate their portfolios over the next 12 months.

What can you do right now?

The question then becomes…will you be one of those who survive and come out the other side of this pandemic thriving in a new financial era, or will you lose your way amidst the panic?

It’s said that necessity is the mother of all invention. It’s certainly the catalyst for innovation and creation, which is what we’re being called on to consider now.

Those who’ll exit this proverbial sh*t-show smelling like roses, are the investors who remain calm, clear-headed and focused on the big picture right now. Not the ones who knee-jerk react in the immediate here and now.

Here at Trilogy Funding, our advice to clients would be;

-

- Take stock of your current financial circumstances and investment portfolio.

Can you comfortably maintain your position, or do you need to make some tweaks? Even short term changes to your personal budget and expenses can make the world of difference right now.

-

- Talk to your lender.

If you feel you might struggle somewhat under additional financial pressure right now, don’t be afraid to approach your lender and see what assistance they can provide. Many lenders are putting mortgages on hold for extended periods, particularly for property investors, as the government incentivises landlords to hang onto their rental properties.

Do be aware however, there’s no such thing as a free lunch in the financial world! What you don’t pay now, you’ll be required to pay later.

-

- Be innovative!

Talk to your property management team about different strategies you can use to attract and retain good long term tenants, who are a Godsend at times such as these.

How can you work with your current tenants to ensure their peace of mind?

How you behave now as a landlord, will have a lasting impact on how your tenants perceive you, and whether they want to hang around at the end of their lease. Remember to think long term!

You should also speak with your property management team to keep abreast of any temporary legislative changes to the Residential Tenancies Act in your state, which could affect you or your tenants.

-

- Seek professional guidance.

Now is not the time to wander this wilderness alone! If you’re feeling a little lost at sea with all of this, make a call to your advisors to seek their insight and guidance. It’s what we’re here for!

We have many strategies, tools and tips for securing your housing assets at this time. Don’t be afraid to reach out with any questions or concerns…no matter how trivial you think they might seem.

-

- Keep a level head.

Investing in property to create wealth has always been a long term strategy, with anticipated short term fluctuations. Remember, as with every X-factor we encounter in the property game, this too shall pass.