Positive cashflow property is the holy grail of property investing. It’s what allows investors to buy properties and service loans without dipping into other income sources (i.e. without negatively affecting your current lifestyle).

And it’s what enables investors to leapfrog from one investment property to multiple properties – ultimately providing wealth (through capital gains) and income (through rent) for the lifestyle you really want.

This article seeks to explain what positive cashflow property is, common mistakes and risks to avoid, and a positive cashflow property plan you can follow to accelerate your wealth.

- What is Positive Cashflow Property?

- Typical Positive Cashflow Property Example

- Positive Cash Flow vs Positive Gearing Explained

- Positive Cash Flow vs Negative Cashflow Explained

- Top Benefits Of Cash Flow Positive Property

- Risks and Pitfalls to Avoid

- Where to Find Positive Cashflow Properties

- Helping You Finance A Positive Cashflow Property

What is Positive Cashflow Property?

Definition: Positive cashflow property is a type of investment property where the yearly profit exceeds the yearly expenses (after depreciation and tax deductions).

That is, a positive cashflow property doesn’t cost you a cent to own – it actually puts money into your pocket each year.

Not only does this add to your yearly income, it allows you to hold the property for no cost while it appreciates in value, growing your overall wealth.

Let’s look at a typical example.

Typical Positive Cashflow Property Example

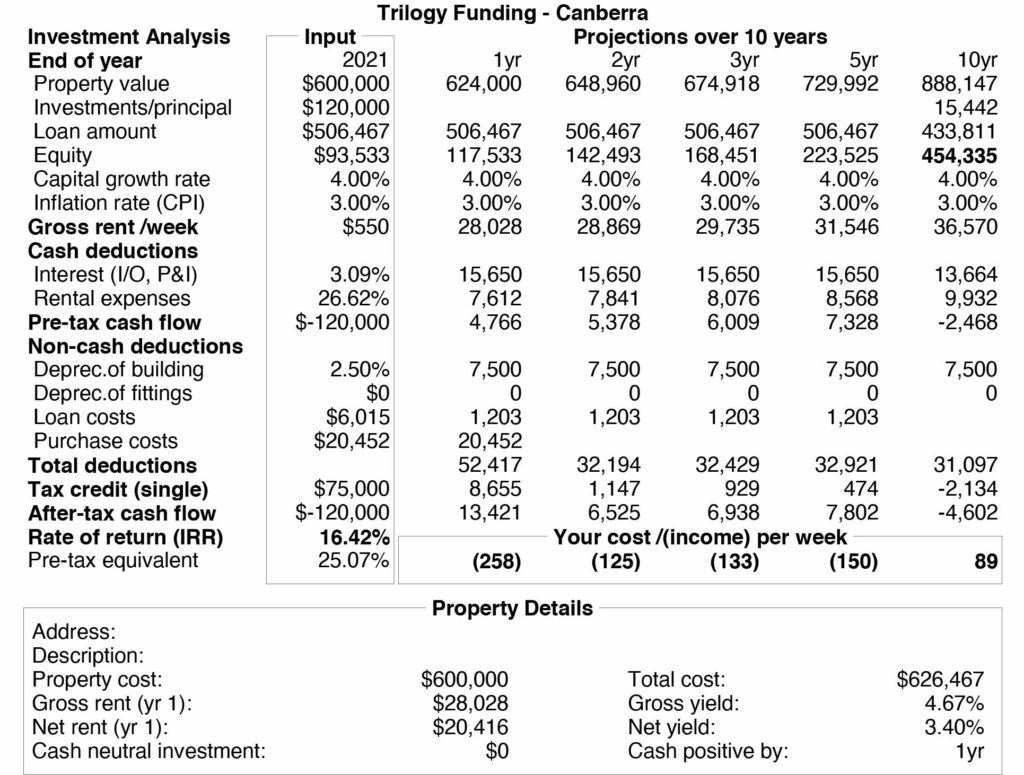

Every investment scenario is different. So, you should never expect your experience to be identical to that of another investor. But to give you an idea of what a typical positive cashflow property may look like, here is an analysis from one of our clients.

Let’s take a closer look at the relevant figures:

| Expenses | Income |

| Purchase Price $600,000 | Rent = $28,028 p.a. |

| Mortgage Repayments $15,650 | |

| Management Fees $2,862 | |

| Maintenance $1,000 | |

| Rates $2,500 | |

| Insurance $1,250 | |

| Yearly Total $ 23,262 | Yearly Total $28,028 |

As you can see, before depreciation and tax deductions, this investment property puts $4,766 per year or $91.65 per week into the investor’s pocket in the first year.

As the rental income increases (through inflation), the cash surplus grows to $140.92 per week after 5 years.

At first this may not seem like an exciting income from a $120,000 cash investment.

But when structured in this way (positive cashflow), the investor:

- Makes $23,481 cash income over 5 years (before tax deductions)

- While holding an investment that appreciates by $129,992

- Giving a total return of $153,473 over 5 years

This investor can choose to spend the monthly income along the way on lifestyle (perhaps an extra dinner out per month) or put it towards another property that produces a similar result.

Positive Cash Flow vs Positive Gearing Explained

Although it sounds similar, positive gearing is slightly different to positive cash flow.

| Positive cash flow property | Positive geared property |

| Relies on depreciation and tax deductions to exceed expenses | Rental income alone exceeds expenses (without taking depreciation and tax deductions into account) |

Importantly, both produce a cash surplus (i.e. enabling you to hold the property without negatively affecting your current lifestyle).

And as rents increase over time, your positive cash flow property is likely to become a positive geared property, giving you an even larger yearly cash surplus (or more leverage to invest in other properties).

Positive Cash Flow vs Negative Cashflow Explained

While the overall yearly outcome of a positive cashflow property is a financial surplus (money in your pocket), a negative cashflow property produces a financial loss (costs you money each week).

So why is negative cashflow property investment so popular?

Many investors accept a short-term loss on a property, so they can gain a much larger long-term profit as the property increases in value.

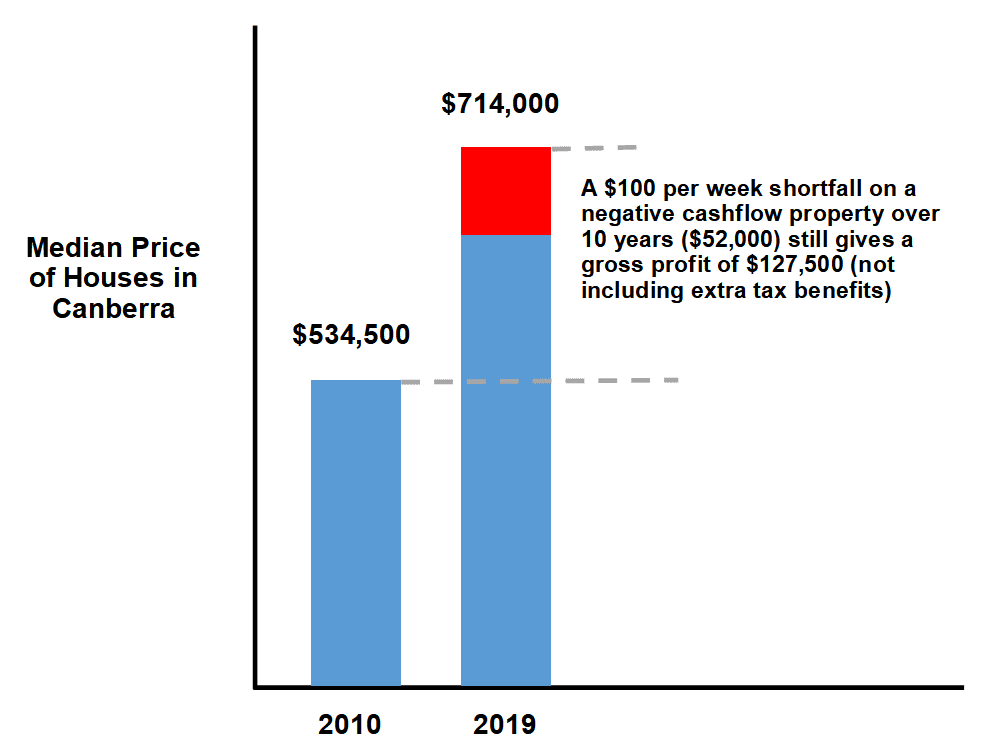

Figures taken from: https://au.finance.yahoo.com/news/a-look-back-at-house-prices-over-the-decade-200023463.html

In this example of an average house in Canberra (demonstrated in the above graph), you can see that a shortfall of $100 a week (total of $52,000) would still have produced a gross profit of $127,500 over the past 10 years (due to capital gains).

And that’s without taking extra tax benefits into account.

Many negative cashflow properties can still be considered worthwhile investments.

But the extra short-term expenses of a negative cashflow property can cause two challenges:

- Negatively affect your lifestyle

$100 a week may not seem like much. But over a year it adds up to $5,200. This extra pressure on the budget may force some families to make lifestyle compromises (like forgoing a meal out each fortnight or cutting an annual beach holiday by a week). - Prevent you from investing in more properties

Negative cashflow properties are often the bottleneck that prevents investors from buying more properties. At some point, the constant cash drain means you simply can’t service extra loans.

Figures from the Australian Tax Office reflect this:- 72.8% of property investors own only 1 investment property

- 18% have 2 properties

- Less than 1% (0.9%) have 6 or more properties

A properly structured portfolio of cashflow positive properties solves both these challenges. Keep reading to discover more benefits of cashflow positive properties.

Top Benefits Of Cash Flow Positive Property

Investors who add cashflow positive properties to their investment portfolio enjoy many benefits including:

- Self-Supporting: Cashflow positive properties pay for themselves (i.e. income more than covers expenses). So, any capital gains you enjoy, is like making money out of thin air.

- Highly Leverageable: Surplus income can be leveraged to buy subsequent properties (a portfolio) that further accelerates your progress towards your wealth goals.

- Lifestyle: As your cashflow property investments mature, your surplus income will increase further, providing you with an even better lifestyle as you continue to invest.

- Less Risk: The income generated by cashflow positive properties provides a buffer that can protect you in case finance or property markets move unpredictably.

But not all cashflow positive properties are equal. Here are some risks to be aware of.

Risks and Pitfalls to Avoid

Investing in the right cashflow positive property can be a lucrative strategy. But like most things in life, execution is key. Buying the wrong property, with the wrong financial structure, could undermine your entire investment goals. Here are some traps to be alert to:

- High Risk Caution: Some properties that demonstrate exciting positive cashflow potential on paper may not be as lucrative as they first appear. Some are just too risky to consider. And many fall short on capital gains. Take extra care when considering short-term or specialist rental situations like serviced apartments and holiday rentals.

- Capital Gains Forecast: It may seem attractive to invest in a property that pays $100 a week into your pocket. But remember that most of your long-term profits will come from capital gains. Be sure to balance cash flow with capital gains to maximise your overall return on investment.

- Marketing Promises: Some properties come with perks like rebates and rental guarantees that make them appear to be cashflow positive. Do your homework to ensure the figures stack up without the incentives, so you’re not stuck with a lemon when the rental guarantee expires.

- Balanced Structure: While many properties depend on non-cash deductions and depreciation to become cashflow positive, be careful these accounting strategies (like a favourable depreciation schedule) aren’t the only things the property has going for it.

- Know the Rules: If a property is relying on a depreciation schedule to be cashflow positive, make sure the property is new and you are the first owner. Seek independent advice about these and other rules that may affect your investment outcome.

- Prepare for the Unexpected: Nobody has a crystal ball with perfect vision into the future. We all need a ‘plan B’ in case the things we can’t control (like interest rates, rental demand, capital gains) go differently than we expect.

Don’t let these things put you off investing. Rather let them be a reminder to invest wisely with thorough due diligence.

Where to Find Positive Cashflow Properties

While cashflow positive properties are not always easy to uncover, they are the key to building a portfolio of multiple properties without sacrificing your current lifestyle. So, they are worth looking for. Here are some tips to help you find them:

- Supply and Demand: This is the key drive that influences prices in property (and all markets). When demand is high (for renting or buying), prices tend to rise. Look for areas where demand is growing faster than supply.

- Regional Planning: Infrastructure development creates jobs that attract people to an area. Keep a close eye on areas earmarked for future development.

- Community Context: Don’t become fixated on one suburb – watch what’s happening in neighbourhoods nearby. When prices rise in one suburb, the positive ripple often flows to surrounding areas.

- Vacancy and Yield: Greater rental demand means houses rent faster and for higher prices. Look for areas with vacancy around 3% and yield around 5%.

- Let History Be Your Guide: Analyse past data to spot trends. For example, if a suburb has just undergone a sharp prise rise, it’s unlikely to experience the same exciting growth again straight away. But this may indicate opportunities in neighbouring suburbs that are about to follow suit.

- More than Property: Property is only one piece of the cashflow positive puzzle. Finance and investment structure (including tax implications) are equally important in helping you achieve a successful investment of short-term cashflow and long-term growth. Seek information and expert advice in all of these areas.

Helping You Finance A Positive Cashflow Property

Now you have a grounding in what positive cashflow property is and why it is so attractive to investors.

It really is the holy grail of property investing – enabling investors to accumulate multiple properties without sacrificing your current lifestyle, so you can accelerate your progress towards wealth.

The next step is putting together a positive cashflow property plan and arranging finance. The team at Trilogy specialise in helping investors get a better loan with a lower rate, more favourable terms and conditions, and the right structure for maximum return on investment.

The quickest and easiest way to learn more is to request a Free 30-Minute Finance Strategy Session during which you will…

- Get an up-to-date picture of the lending landscape including rates, conditions, and special loans for cashflow positive investors

- Gain greater clarity over where you want to be in terms of owning investment properties (and how to structure your loans to get their the fastest, safest way)

- Discover how to unlock the equity in your current properties, so you can build your portfolio – and your wealth – faster (and enjoy a better lifestyle now and in retirement)

- Discover clever, no-cost ways to save money on interest, fees, and charges — immediately

- Learn about our unique process to find you a better loan that will save you thousands.

This no-obligation free session will be held with one of our experienced mortgage brokers who specialise in structuring cashflow positive property investments.

Please be assured this will not be a thinly disguised sales presentation. On the contrary, you’ll receive our best strategic advice, specific to your situation, so you too can accumulate multiple properties without sacrificing your current lifestyle and accelerate your progress towards wealth.

Schedule Your FREE 30-Minute Finance Strategy Session Today

Please note, the numbers and assumptions listed in this article are for educational purposes only. Individuals should seek specific advice pertaining to their unique situation and the real estate market before making any decisions.

Trilogy Funding Two is a corporate credit representative (Representative Number 506131) of BLSSA Pty Ltd, ACN 117 651 760 (Australian Credit Licence 391237)