The Australian property market has undergone rapid changes in the last 12 months. Prices and the supply of properties available for sale have fluctuated at break-neck speeds in many major markets. Even the regional markets went along for the ride.

Here is a quick wrap up of some need to know facts and figures that provide a snapshot of the Australian property market at the 2021 end of financial year (EOFY).

National: The Reserve Bank of Australia (RBA) decided to hold the cash rate at 0.1%. In the statement by Governor Phillip Lowe, he re-affirmed the RBA’s commitment to providing continued monetary support to assist economic recovery.

“ Housing markets have continued to strengthen, with prices rising in all major markets. Housing credit growth has picked up, with strong demand from owner-occupiers, including first-home buyers. There has also been increased borrowing by investors. Given the environment of rising housing prices and low-interest rates, the Bank will be

monitoring trends in housing borrowing carefully and it is important that lending standards are maintained”, the Governor remarked.

The value of the Australian property market closed out the EOFY 13.5% higher. This figure is one of the highest on record since the 2004 prices that closed out the 2000’s property boom.

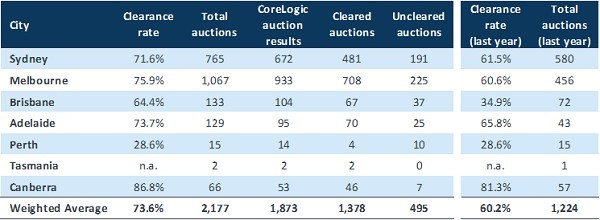

Australian Capital Territory (ACT): Canberra was the only capital city to record even mightier price growth in the month of June, adding an additional 2.3% in June. Canberra still also holds the record for the capital with the most expensive average rents in Australia. The takeaway here is that Canberra offers wonderful opportunities for investors who are seeking both high yields and capital growth.

New South Wales (NSW): The NSW lockdown entered its third week on the 12th of July 2021. Restrictions were imposed on Greater Sydney, Blue Mountains, Wollongong and the Central Coast on the 26th of June. The infection rate continued to surge in the first weeks of July and the restrictions have been ramped up and other Australian states are closing their borders to NSW residents.

Vacancy rates continued to drop in Sydney, down by 0.2% to sit just above 3% for the month of June. While vacancy rates in regional NSW have reached historically low levels. According to REINSW

“…tenants continue to exit the major metropolitan markets to secure a property that suits both their budget and desired lifestyle”.

Source: CoreLogic

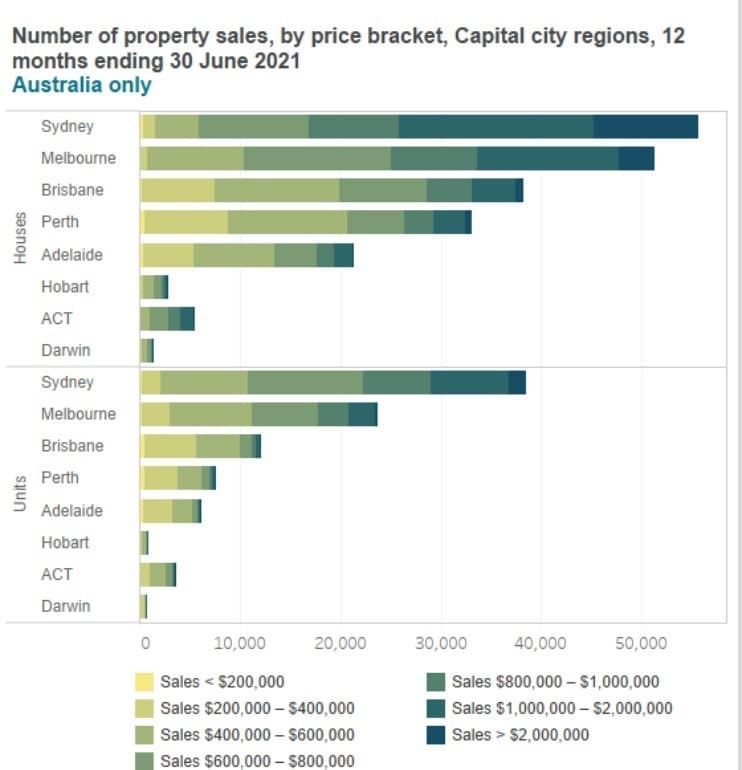

Median property values in Sydney had surpassed $1.2 million by the EOFY 2021 and reported a 19.3% growth. Sydney is still the most valuable property market in Australia, accounting for over 40% of the total property in Australia.

Victoria: House prices in Melbourne have risen by 10% in the last year and the market recovered very well after the extended lockdowns. Properties in Regional Victoria are also being sold at a break-neck pace with days on market (DOM) sitting at less than 40 days on average.

Source: www.reiv.com.au

Queensland (QLD): 97 suburbs across QLD achieved an average house price of $1 million or more. Auction clearance rates have almost doubled compared to this time last year in Brisbane indicating that the property market is making a strong recovery from the lockdowns.

South Australia: 99.3% of properties sold in the Adelaide Hills council area returned a profit for their former owners with an average profit of $195k. “Adelaide’s property market is the most profitable it has been in almost a decade”, according to CoreLogic’s Pain and Gain report.

Western Australia: Properties in Port Hedland shot up by 34% thanks to a resurgence in iron ore projects attracting FIFO workers. After having surged to average prices of $900k in 2011, the recent growth in prices has recovered some of the losses from this historic high to hit a new average of $350k up from the low of $200k. Salter Point in Perth achieved the largest growth in price for the capital city recording a 44.7% growth and a median price of $1.352 million.

Tasmania: The average annual rent for homes in Launceston increased by a whopping $5,200. DOM for properties in Hobart has dropped from 38 to 20 days and the prices of regional properties in Tasmania has grown by a staggering 20%.

Northern Territory: Darwin’s property market has achieved an 18.2% increase in house values and 9.5% for units. These figures are amongst the strongest in Australia over the last 12 months.

The Australian property market closed out the last financial year in a very strong position with record-breaking price growth and median property prices that have exceeded the expectations of most. There are some concerns that the resurgence of COVID-19 – in the Delta variant – may derail this trajectory. However, the length of the lockdowns will eventually determine how much of a hit the markets actually take.

The road to economic recovery is supported by government policy. These policies are designed to mitigate the financial losses that are suffered by individuals and business owners. Australia also does have a blueprint for post-lockdown recovery from 2020 that may help to expedite the process.

Contact Trilogy to claim your free 30-minute finance strategy session. If you are a new and existing investor, we can help you strategically build and grow your property portfolio. Even in a rapidly changing and competitive property market, there are opportunities for smart property investors to build wealth.