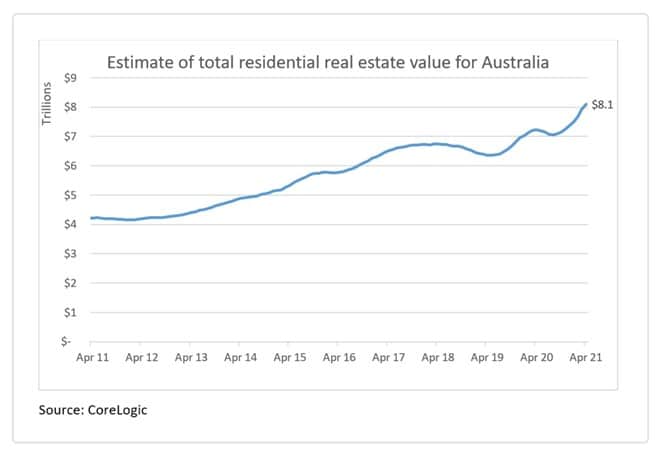

The Australian residential property market has reached a record valuation of $8.1 trillion! It is now worth more than commercial real estate, the ASX and superannuation combined.

Source: Core Logic

This means that at the time of writing, the property market is the primary source of Australian wealth and most homeowners have a considerable amount of equity. According to the RBA, there are only 1.3% of home loans in a negative equity position.

The Australian property market is an attractive investment option-now more than ever before – with new and existing investors looking to get the best piece of the $8 trillion pie. Deciding where to invest in Australia will depend upon your long-term investment and retirement goals. However, one thing we can all agree on is that we want to avoid a negative equity situation, and we want to reap the benefits of strong capital gains and rental yields.

If you have devised a solid investment strategy, can secure and service a loan for the required amount and have an expert team of advisers behind you: there are key pieces of data that you can leverage when picking the best place for you to invest in the Australian residential property market.

- For Strong Rental Returns

Positive gearing is considered to be a unicorn of sorts, to property investors with a goal of making passive income and improving serviceability. While it is not always easy or even possible to achieve positive gearing on every deal, a strong rental yield is still a prerequisite for most astute investors.

For investors who are chasing cashflow when making property investment decisions, a recent report by CoreLogic found that – in the last 12 months – the following capital cities and regional areas may provide more bank for your buck:

Best gross rental yields for houses in capital cities

- Darwin 5.6%

- Hobart 4.4%

- Perth 4.3%

Best gross rental yields for units in capital cities

- Darwin 7.2%

- Canberra 5.5%

- Perth 5.4%

Best rental yields for houses in regional areas

- Northern Territory 6.3%

- Western Australia 5.9%

Best rental yields for units in regional areas

* Western Australia 8%

Source: Core Logic

- For Strong Capital Gains

Capital growth is a long-term investment strategy that can generate strong net worth gains. It is also a good short and medium-term goal for investors who are capable of manufacturing value through repairs and renovations.

Despite its higher than average dwelling price, Sydney has attracted the bulk of the property investment dollars in the past decade. It has regularly topped annual capital gains figures, with houses achieving a median of 6.6% and units 4.5% year-on-year.

In the last year, Sydney has fallen behind other capital cities and regional areas that have returned higher capital growth for houses and units.

Biggest capital growth in houses

- Darwin 18.2%

- Regional Tasmania 17.8%

- Regional New South Wales 16.3%

Biggest capital growth in units

- Regional Victoria 13.6%

- Hobart 11.6%

The new winners in the capital growth race – over the last 12 months – have a significantly lower average dwelling price than Sydney. Although they are yet to establish a track record of continued strong growth that would rival the Sydney market, these areas are worth a closer look and some consideration.

Source: CoreLogic

- For a Combination of Strong Capital Growth and Rental Yields

Capital growth and rental returns usually have an inverse relationship. Meaning that property investments that return high capital gains will generally have low rental yields. While those with high rental yields generally return smaller capital gains.

Despite this general rule of thumb, some investors have successfully achieved both high yields and capital growth in some of the Australian property markets over the past 12 months.

Best total returns for houses

- Regional Tasmania 24.5%

- Darwin 24.4%

Best total returns for units

- Regional Victoria 19.3%

- Regional Queensland 16.9%

When you drill down deeper into the data and past the averages across a capital city or region: Crace, ACT is the Australian suburb that has offered the best combined average return over the last decade.

Source: REA Insights

If you are wondering where you should invest for the best return in the Australian property market, the answer is that it will depend on your investment strategy. While 12 month and 10-year average yield and capital growth figures provide valuable insight into which areas are doing well, there is no guarantee that these figures will remain constant or continue to grow in the next year. The best use of this information is to use it as a guide to kick off your research into the best suburb for your next property investment.

If you are looking to acquire your next investment property, the Trilogy team can help you to structure your new and existing loans so you don’t miss out on the perfect property that will meet both your yield and capital growth goals. Even if you have a large or complex portfolio. Even if the banks have already said No. Trilogy deliver solutions that get you to the Yes.

Book a free 30-minute strategy session today.