As almost every homeowner in Australia knows, the Reserve Bank of Australia (also known as the “RBA”) is implementing a range of monetary policies to reduce our recent unwanted rise in economic inflation. One of these policies involves a gradual increase of the national cash interest rate target, which in turn increases average mortgage interest rates (resulting in higher monthly mortgage repayments).

It should come as no surprise that these rising rates are causing ‘mortgage stress’ for many homeowners, as they are now forced to pay more each month. However, as difficult as it is, the RBA is implementing this policy for an important reason. Economic theory suggests that higher mortgage repayments cause a decrease in discretionary spending, thus reducing damaging inflationary effects. This is painful for many, but it has broader positive effects on our economic system.

In this post, I want to zoom out a little and explore the concept of inflation. Surprisingly, inflation isn’t necessarily all that bad—in fact, some inflation is desirable in economies like ours.

How does inflation happen, and what does it impact?

In very simple terms, inflation can be defined as a gradual increase in the prices of things we buy (“goods and services”). The causes of inflation are complex and varying, and include:

- An increased supply of money. When there is an increased volume of money circulating throughout an economy (mostly for discretionary spending), prices for goods and services increase. An example of this can be seen in our post-lockdown environment, where many people had/have higher bank balances (and therefore more money to spend). This can contribute to inflation.

- An increase in demand for things. Increases in populations or economic activity can stimulate an increase in demand for certain goods or services, leading to inflation.

- Higher production costs. If production costs, including the purchasing of raw materials or paying wages, etc. are increased, inflation may occur.

- Supply shortages. Shortages caused by economic or political instability can cause prices to rise across the board, thus contributing to inflation.

In simple terms, inflation reduces purchasing power (which means the money we earn buys fewer goods).

In Australia’s case, COVID-19 triggered ‘demand-led inflation’ whereby, in our post-pandemic environment, the demand for goods and services became higher than supply.

Why does the Reserve Bank of Australia try to keep inflation at a manageable level?

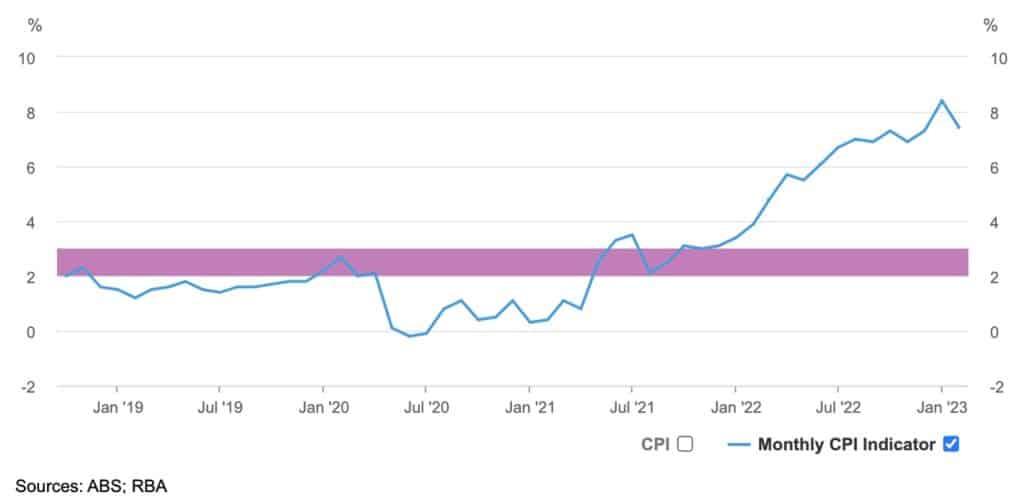

The Reserve Bank of Australia (RBA) aims to keep inflation within a targeted range of 2-3% each year in order to ensure economic stability. Too much inflation causes the issues mentioned above. Too little inflation can under stimulate important economic activity and stall economic growth.

This 2-3% target sustains the purchasing power of local currency, creates incentives for businesses to invest, and stimulates investment and consumer spending. Additionally, keeping inflation within this range helps the RBA balance unemployment levels against inflationary pressures, ensuring that there is job growth whilst maintaining price stability.

Why is *some* inflation important?

Interestingly, some inflation is desirable by economies like ours—as it encourages consumer spending and incentivises businesses and individuals to invest in new products or services. Additionally, inflation helps protect against a deflationary recession, as it keeps wages and prices from falling too low.

What’s the outlook? Is there relief coming soon?

The “Monthly CPI Indicator” is one of the RBA’s metrics for measuring inflation. As you can see below, the pink band is the target band of 2-3%. In recent times (December last year), inflation increased to approximately 8%, however this now seems to be reducing.

What will happen next? Who knows. Hopefully the RBA’s strategies are working, and we’ll see interest rates decline sometime soon.

Can We Review Your Current Interest Rate And Loan Conditions?

If you’re like many mortgage holders, you might be experiencing the pinch of rising interest rates. This means it’s even more important to review your current loan and lending structure to ensure you’re not overpaying.

If you’d like an independent review of your current loan(s),request a 30-Minute Finance Strategy Session during which you will…

- Get a better understanding of the lending options available to you, so you can buy or refinance with confidence

- Discover no-cost ways to save money on interest, fees, and charges

- Get an up-to-date picture of the lending landscape including rates, conditions, and how to structure loans

- Learn about our process to find you a better loan that could save you thousands.

This no-obligation session will be held with one of our experienced mortgage brokers.

Please be assured this will not be a thinly disguised sales presentation. On the contrary, you’ll receive our best strategic advice, specific to your situation, so you too can accumulate multiple properties without sacrificing your current lifestyle and accelerate your progress towards wealth.

Schedule Your FREE 30-Minute Finance Strategy Session Today

Please note, the numbers and assumptions listed in this article are for educational purposes only. Individuals should seek specific advice pertaining to their unique situation and the real estate market before making any decisions.

Trilogy Funding Two is a corporate credit representative (Representative Number 506131) of BLSSA Pty Ltd, ACN 117 651 760 (Australian Credit Licence 391237)