SQM research figures indicate that total residential property listings fell by 6.3% in May 2021. Demand from buyers is still so high that, undesirable properties which have remained unsold for more than 6 months, are now being snapped up.

Both owner-occupiers and investors are driving this overwhelming demand for residential dwellings in Australia. The factors underpinning the strong property market: low-interest rates, Government stimulus and economic recovery continue to support buyer demand. However, there were 1,970 fewer properties advertised in May 2021; spurring on a sense of urgency among house hunters who fear missing out.

National home values have increased by another 2.2% in the last month. The disparity between th

e skyrocketing demand for residential dwellings and, the falling supply of available properties listed for sale is a contributing factor to the recent price boom.

“We’re still seeing it’s not quite as rapid as it was in March, but 2.2 per cent is still extreme especially when you consider wages are rising by 1.5 per cent per annum,” – Tim Lawless, CoreLogic.

Total National Property Listings in May 2021.

The total number of residential properties listed fell from 262,617 in April 2021 to 245,953 in May 2021. This significant drop compounds the shortage of supply which saw a 19.2% drop in the total number of listings that was recorded in May 2020 (the year prior).

The biggest drops in total property supply were in;

- Hobart (-11.2%)

- Canberra (-9.7%)

- Melbourne (-7.4%).

New Property Listings in May 2021

79,673 new properties were listed for sale in May 2021 in the Australian property market. This number is down by 2.4% from the April 2021 figure of 81,643.

The most significant drop in new property listings was in;

- Hobart (-16.2%)

- Canberra (-7.5%)

- Melbourne (-6.8%).

The drop in new property listings for the Melbourne market is to be expected given the unfortunate surge in new COVID-19 cases and the subsequent lockdown.

Source: SQM Research

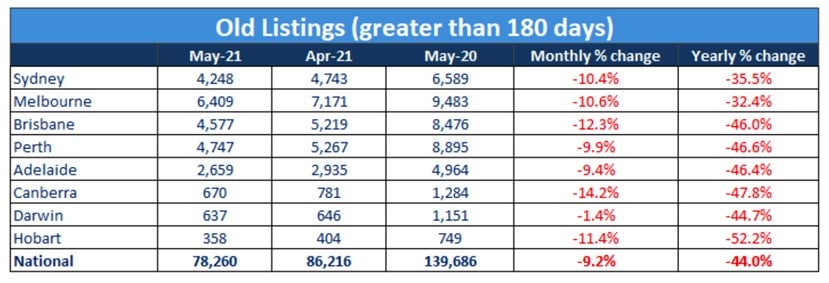

Change in Older Listings May 2021

A fascinating revelation that was uncovered in this data regarding older property listings – on the market for more than 180 days – is that they are now selling at a staggering rate. Old property listings decreased by 9.2% in May 2021 and by 44% in the last year.

According to the research managing director at SQM: “It’s abnormal to see such falls in older listings because those listings are usually there for a reason…. Either the vendor is asking too much for the property, it’s in a bad location or there are maintenance issues.”

Despite the unappealing characteristics that have previously contributed to the difficulty moving the older stock, the recent surge in buyer confidence and a drop in property supply has caused these properties to be desirable again. Buyers understand that the low-interest rates make up for any quirks or undesirable features in the dwelling.

The most significant drop in old property listings in the last month were recorded as follows:

- Canberra (-14.2%)

- Brisbane (12.3%)

- Hobart 11.4%

The fall in old property listings in the last 12 months was:

- Hobart (52.2%)

- Canberra (47.8%)

- Perth (46.6%)

Source: SQM Research

The favourable economic conditions and low-interest rates are enticing both owner-occupiers and investors back to the property market in droves. Not to mention first-home buyers who are now more supported by targeted deposit savings schemes. The demand for residential dwellings in Australia has grown so quickly that the supply of suitable listings is having trouble meeting the demand. Consequently, record-breaking jumps in the price of houses and units are inevitable.

These favourable conditions are predicted to continue – in a more subdued fashion – as long as interest rates remain low, demand outpaces supply and APRA does not impose any new lending restrictions on owner-occupiers or investors.

Australian property has a track record of generating impressive returns for its owner. If an investor purchased a house in Sydney in 1990 and held it, they would have paid an average price of $150,000 and would have enjoyed a capital gain of almost $1 million by 2021. Given the potential to amass this type of return on investment (ROI), an Australian who can get on the property ladder or grow their property portfolio would jump at the chance.

If you have your eye on an unmissable property, get in touch with the Trilogy team for a detailed property investment strategy. Let us help you to secure the best home loan at the best interest rates, so you don’t have to miss out on the perfect property for you.

Book a free 30-minute strategy session now.