People love to follow the crowd. You can see it in our reactions and responses to different market reports, particularly when it comes to property.

Slowdowns or downturns (perceived or real) perpetuate even more of a slow down, as we all bluster about the current tragedy of the day. While good times stimulate increased activity and produce buoyant markets. It’s the nature of the beast.

In this sense, all of the statistics and fundamentals available to us now, as educated investors in an online world, can be both a help and a hindrance.

Data is easily influenced by people and vice versa, so there’s a constant ‘push me-pull you’ type relationship at play in the dollar values, clearance rates and capital gains coming from an increasing number of industry analysts.

Many don’t appreciate how influential all of this widely varied reporting actually is on investor psychology. Particularly new investors who might feel a little overwhelmed and over-exposed to begin with and can therefore spook easily.

Then you have circumstances brought about by regulatory policy, such as the recent macroprudential talk from APRA that’s seen the banks brought to heel, forcing changes to their loan assessment processes in an alleged bid to cap investor based borrowing growth at 10%.

Of course all the while, construction of new apartment stock across our major cities and foreign investment in Australian real estate is being heavily encouraged, as two important drivers of our overall economy right now.

Fortunately, Australia still has a relatively high rate of home ownership (although on a decline) relative to investors.

Hence, if interest rates were to rise or the property markets cool off in any way to cause significant panic among some property investors, large sectors of our markets would remain fairly unscathed; being those areas where there’s a large demand for owner-occupied housing.

Such is the case with Sydney

Interestingly, back in 2003 when the Sydney housing market was rising exponentially on the back of investor led activity and showing no signs of letting up any time soon (see below graphic), APRA started to publicly voice its concerns about runaway lending practices fuelling activity.

It implemented changes to capital requirements and made adjustments to mortgage insurance in a bid to moderate the market, taking similar steps to what it’s currently been talking about.

The difference now, as pointed out by commentator Pete Wargent, is that a decade ago the Reserve Bank had the capacity to team up with APRA, raising interest rates from 4.75 per cent to 5.25 per cent through two rapid and successive hikes across November and December 2003.

Wargent says the next quarter of data from Sydney was very telling, in how well this partnering worked to put a lid on the boiling Harbour City housing market.

Of course our current economic climate is vastly different to that of 2003, before the full force of the GFC and a slowing resources sector hit, compelling a succession of rate reductions that started in 2009 and really ramped up at the beginning of 2012.

Now the RBA has no choice but to sit on its hands and watch from the sidelines as APRA tries to force Sydney to a stop on its own, at a time when interest rates can still be fixed at an astonishingly low 4 per cent.

Then there’s the supply issue

The RBA’s interest rate impotence is doing little to help APRA’s cause in effecting any type of significant growth slowdown, to give Sydney homebuyers a slight reprieve from rising property prices.

More problematic however, particularly when it comes to maintaining any type of consistently sustainable capital growth across the city, are the ongoing accommodation supply constraints in the face of today’s quickly growing population.

In the year to September 2003, Wargent reports that almost 33,000 people migrated out of New South Wales. From the below image, it seems most were heading to the sunnier pastures of Queensland.

Fast forward to 2015, and you have the lowest rate of interstate migration away from NSW ever recorded. Even as the local population grows at a rate of over 105,000 per annum, with many seeking work in what’s fast becoming the employment hub of our increasingly service oriented jobs sector.

Under pressure

Although many argue that an overflowing pipeline of OTP apartment stock is the biggest threat when it comes to derailing Sydney’s runaway property market, the fact remains that there’s still simply not enough to go ‘round when it comes to housing the city’s growing resident pool.

Developable land in Sydney is dangerously close to extinction. This very finite capacity to construct new dwellings will continue to underpin a strong and oftentimes bullish market into the future.

As depicted in the below chart from Wargent, even as the population in NSW is on an upward trajectory, the number of new houses and units being built is declining, rather than mirroring this rate of resident growth.

Vacancy rates reveal more

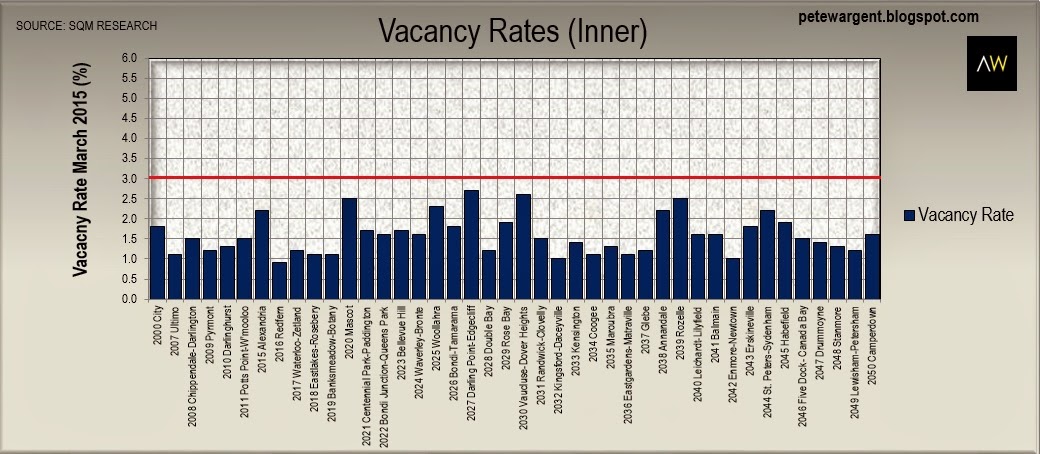

Further evidence that this supply/demand imbalance is set to worsen for inner city Sydney-siders, and place continued pressure on pockets of the property sector, is the current inner city vacancy rate.

Back in 2003/04, data from the Real Estate Institute of New South Wales (REINSW) revealed an emerging trend of notably lower rates of rental vacancy in the inner suburbs (4.4%), compared to the outskirts of town (5.3%).

This is still reflected in today’s vacancy rates, which trend well under the considered equilibrium benchmark of 3% across most of the city’s inner precincts.

More buyers than bricks and mortar

Finally, Wargent points to the fact that as opposed to the predominant investor based boom of 2003/04, today we are seeing a lot of pent up demand from owner-occupier purchasers too.

In fact, the rolling annual lending to owner-occupiers in NSW is presently at its highest historical level and rising fast, at $70 billion.

Even though the market is said to be cooling, with a seeming decline in the number of transactions of recent times as reflected in lower clearance rates, Wargent says this is simply reflective of the fact that vendors are holding back “in anticipation of higher prices”.

He says the level of stock currently on the market in Sydney is “unthinkably low” right now, and until this changes prices will continue to be pushed up by increasing droves of competing buyers – both owner occupiers and investors.

In the Canberra area and want to learn more? Join the Trilogy team and a leading Sydney property market expert on October 21, as we share unique industry insights into the Harbour City’s prime investment opportunities at this time. Click HERE to Learn More.