Throughout Australia’s evolution as a young nation surrounded by older, more established economies, one thing has remained fairly consistent…our love of housing.

We have some of the highest rates of home ownership in the developed world, with people who own or are purchasing a dwelling sitting at around 70% for decades now.

Whether it’s because we’re bred from displaced convict stock and therefore feel an innate desire to establish roots of some kind, or ‘just because’, home ownership holds a special place in our hearts as a cultural icon of personal success.

This strong emotional urge to acquire our own Great Australian Dream makes property an incredibly reliable commodity. In fact it’s the only tradable commodity of the modern capitalist world that’s underpinned, at its most fundamental level, by psychology more than profitable gain.

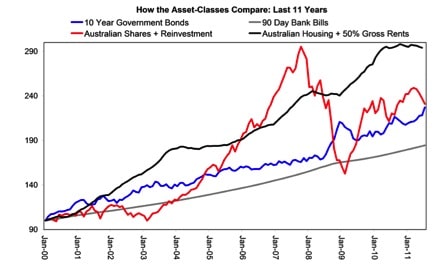

This increases the upside and reduces the risks associated with property as an asset class as compared to say, shares and bonds, which is evident in this 2013 market comparison from Christopher Joye.

It’s also why whatever else might be happening economically, real estate will continue to engender competition among emotional buyers and sellers and therefore, push prices up in high demand/low supply locations.

This is particularly the case when we have boom times in the property cycle, which are generally instigated by a significant economic shift, such as the low interest rate environment of the last two years.

I can’t tell you precisely how expensive an apartment in inner city Sydney or Melbourne might be ten years from now. But I can guarantee that there’ll be a lot of wannabe homebuyers and property investors wishing they’d bought something ‘back then’.

How housing stacks up

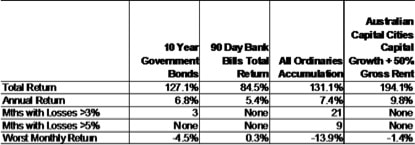

The above graph and below table – again compiled by Joye in 2013 – demonstrate how housing compares side by side with other investments.

While there were nine months over the 11 years to 2013 where Aussie shares fell in value by more than 5%, other asset classes registered no such losses, and the average annual rate of return for real estate outpaced every other commodity by at least 2.4%.

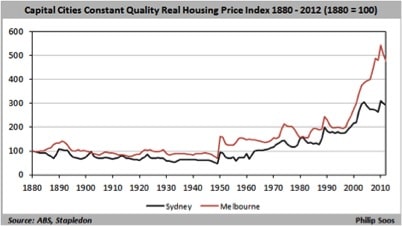

If you need further compelling visuals to convince you of property’s long-term investment potential, consider the Quality Real Housing Price Index 1880-2012 for Sydney and Melbourne.

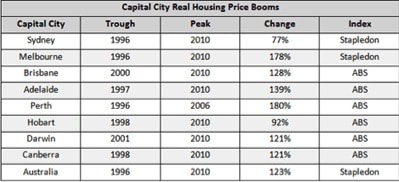

According to ABS statistics, real prices increased by 77% and 178% for Sydney and Melbourne respectively between 1996 and 2010.

It should be noted that the significantly lower growth recorded for Sydney is possibly due to the fact that Melbourne house prices started rising from a much lower base at the outset, allowing for higher prices before the interest repayment burden hits a wage-financed ceiling.

Essentially, the above table indicates that all of Australia’s capital cities experienced a boom in real housing prices beginning in the latter half of the 1990s.

Notably, Melbourne and Perth lead the pack, with report authors suggesting that although Perth’s boom was 2% greater than Melbourne’s, quality adjustments would deflate the index, resulting in Melbourne as the top performer.

Semantics and accolades for top billing aside, the fact remains that well located, quality housing across all capital cities in Australia continues to demonstrate strong price growth, relative to ongoing levels of supply and demand at varying levels of the market.

It may not be consistent year-in-year-out, but if you’re not investing for the long haul, then what do a few market corrections matter in the big scheme of things?

An exception to every rule

Of course as with anything, there’s always an exception and in this case, it’s the potential to end up with the wrong type of asset – that’s not investment grade and therefore not underpinned by a strong supply/demand fundamental.

This usually happens when insufficient research is undertaken as a part of the asset selection process and instead speculative ventures are entered into by large amounts of investors who buy into the latest fad.

In this case, most experts think the inner city new apartment market could be a sticking point when it comes to value growth across our cities over the next five or so years.

Purchasers currently buying into off-the-plan developments in hot spots like Melbourne face a possible double-blow as they pay at the peak of the market today, with the likelihood of settling the property after the market softens.

BIS Shrapnel senior analyst Angie Zigomanis said, “The risk with units is that you have investors buying today in this market, but they will come online in a few years once the building is completed and they may be having to discount rents to find tenants.”

The BIS Shrapnel Residential Property Prospects 2015-2018 report points to overseas migration having tumbled from 237,500 in the financial year of 2012-2013 to just 184,000 across 2014, at a time when new dwelling construction is expected to hit a record level of 210,000 new commencements.

Plus another 200,000 developments are expected to start in the 2015-2016 financial year.

“In general there’s an under supply at the moment and that’s something that has to be eaten away at first,” Zigomanis said.

“But the 210,000 are just being started and so two or three years away, and that’s where we see a reduction in prices coming through.”

Always opportunities

When we buy into the hype around housing markets and bursting bubbles, we risk falling victim to investor inertia, paralysed by the fear of it all going pear shaped.

As you can see though, quality housing in investment grade locations should give you very few reasons to fret about whether you’ll achieve the necessary combination of cashflow and capital required to build a property portfolio.

You just have to make sure you are selecting the best possible assets, in areas with a demonstrated track record of consistently strong owner-occupier and tenant demand.

At the end of the day, housing affordability is relative.

Property, like any other commodity, is worth whatever the market is prepared to pay for it at any given time, which makes the ‘expense’ of real estate more about perception and perspective – if you can afford something, you won’t see it as unattainable. Likewise if you cannot afford it, you might.

Don’t be scared out of the property game by ‘market banter’, because in ten years housing will be more expensive – as history clearly demonstrates.

If you would like to know more about the current investment opportunities across the Melbourne housing market, why not join us at our upcoming seminar on August 20?

The Trilogy team and local market experts will be there to answer your questions and help you navigate your way successfully through a changing property and lending landscape.